Simply the Bust

Bankruptcies are rising, but the bond market still hasn’t got the memo.

Browsing the FT over my morning vanilla latte in the early summer sunshine today (you’re in Essex, not Rome, get on with it: Ed), my eyebrows were raised at an article titled, “U.S. credit squeeze triggers rise in corporate bankruptcies.” Eight companies in the U.S. with more than $500m in debt have gone to the wall this month (filed for Chapter 11 in the lexicon) which compares with a monthly average of only three in 2022 (a 2.618 multiple for those of you keeping track). Twenty-seven corporates identified as “large debtors” (over $500m in liabilities) have gone bankrupt so far this year and that compares with a total of forty in 2022. Clearly, the current deflation of money and credit is having an effect.

Last August, a car drove into the side of my motorcycle. I could see it about to happen and things went into slow motion. Then, bang. Back in 2007, I remember saying to my colleagues on the corporate debt desk at the Abu Dhabi Investment Authority, who were telling us every day that the markets had seized up, that it was akin to watching a car crash in slow motion. Sure enough, a catastrophic pile-up occurred in 2008. This seems to be a similar time.

S&P Global Ratings expect the default rate on speculative-grade bonds to nearly double into 2024, and yet our “downgrade-o-meter,” (the yield spread between the lowest-rated investment grade bonds and those one ranking above) remains stubbornly sanguine, indicating no concern at all about a corporate credit bust.

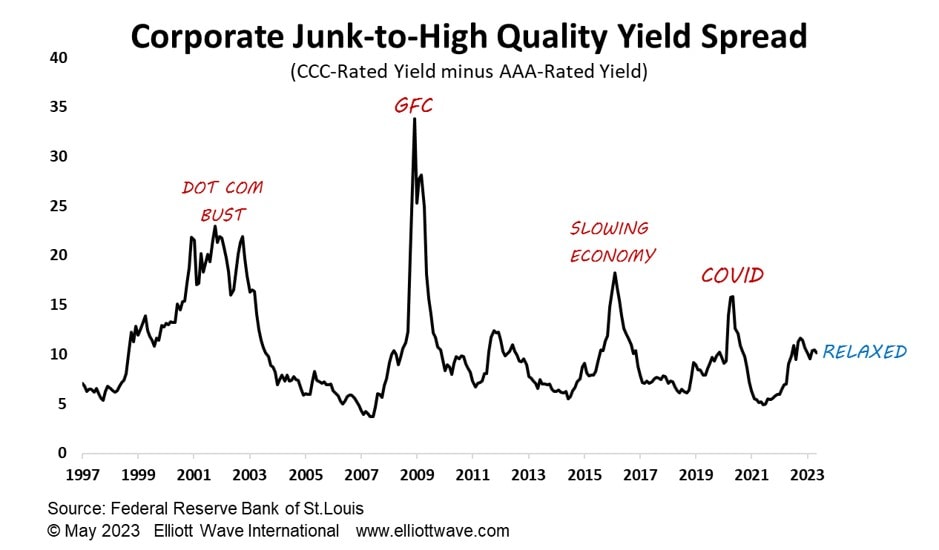

The chart below shows that the yield spread between junk bonds and those corporate bonds rated AAA has widened since its 2021 low, doubling at the peak in November 2022. However, compared with previous recessionary times, and we are almost certainly heading for another one, this gauge of corporate stress is nowhere near those previous extremes. If, as we anticipate, stock markets are set to decline again, expect corporate debt to become a huge issue.