Croak! Defaults Starting to Accelerate.

Debt deflation is happening.

You know that terrible apologue about the frog in a pan of boiling water? Putting aside what kind of brain thought that up in the first place, the point of the story is that the frog doesn’t know it is being boiled alive until the point of its demise. This came to mind when I was thinking about what is going on in financial markets.

The relentless rise in bond yields and interest rates since 2020, accelerating last year, has been akin to the boiling water. One frog in this metaphor was Silicon Valley Bank and, of course, there are others. All of a sudden, it seems, companies are realizing that the water has been boiling for some time.

The December 2022 issue of the Elliott Wave Financial Forecast highlighted the fact that so-called zombie companies, those that can’t produce enough cash to service their debt, have proliferated since 2020. Zombies now account for 24% of the Russell 3000 stock market index (almost a quarter!). The previous peak was 16% during the dot.com bust at the start of the century.

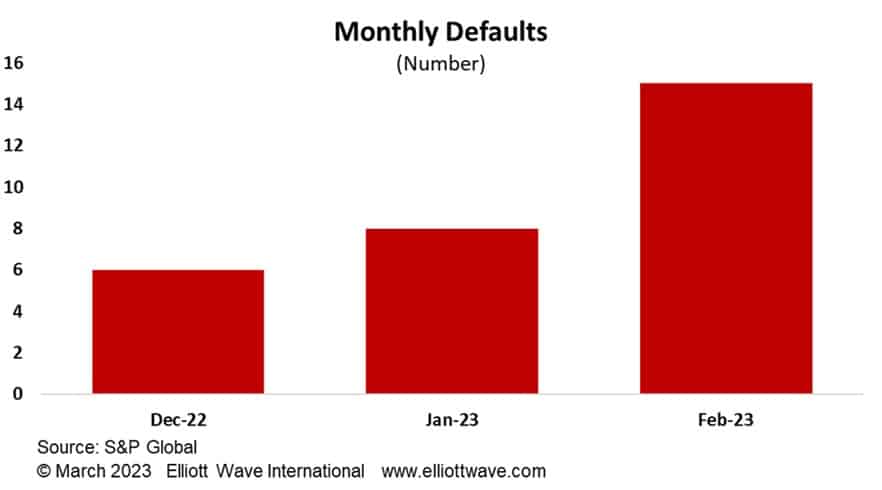

Now, evidence is emerging that debt deflation is starting to ramp up. The chart below shows that corporate defaults have zoomed higher in the first two months of this year and are now at the fastest year-to-date clip since 2009. Credit rating agencies have, shall we say, a ‘checkered’ past but the 12-month average of the number of credit downgrades is sloping up, meaning that the trend is toward deteriorating credit quality. And corporates face a wall of refinancing to be negotiated over the next couple of years.

2023 is fast becoming the year in which people realize that the cost of money and debt has changed, and is not returning to the easy days of the past. Hey, do you smell something cooking?