This is What Debt Deflation Looks Like

Expect confidence in corporate bonds to plummet.

Normally sleepy Switzerland was the center of attention last week after the shotgun wedding between Credit Suisse and UBS. Both banks didn’t want the deal but the Swiss regulator, Finma, insisted on it taking place, even going so far as changing the law and not allowing UBS shareholders to vote on it. Not only that, Finma changed the capital structure, with Credit Suisse bond holders being wiped out as prices have been written down to zero. Normally, bond holders are first in line to get at least some of their money back.

The so-called Additional Tier 1 (AT1) bonds, also known as contingent convertibles (CoCo), were born in 2013 as European banks began looking for ways to boost their capital ratios. It is widely known that AT1 bonds are risky and that if a bank gets into difficulties the bonds could get converted into equity or written down completely. Nevertheless, the wipe out of Credit Suisse AT1s has come as a shock to the system and now other bank AT1 bonds are being re-priced. This increases the cost of capital in the banking industry as a whole and will contribute to a general tightening of monetary conditions and lending standards.

This is what debt deflation looks like. Bonds become worthless. Sure, the AT1 bonds are a unique form of debt, but underlying all bond markets is confidence. The term credit is derived from the Latin word cred which actually means “believe.” When belief or trust goes, things can get very ugly as was aptly demonstrated by the financial crisis of 2008.

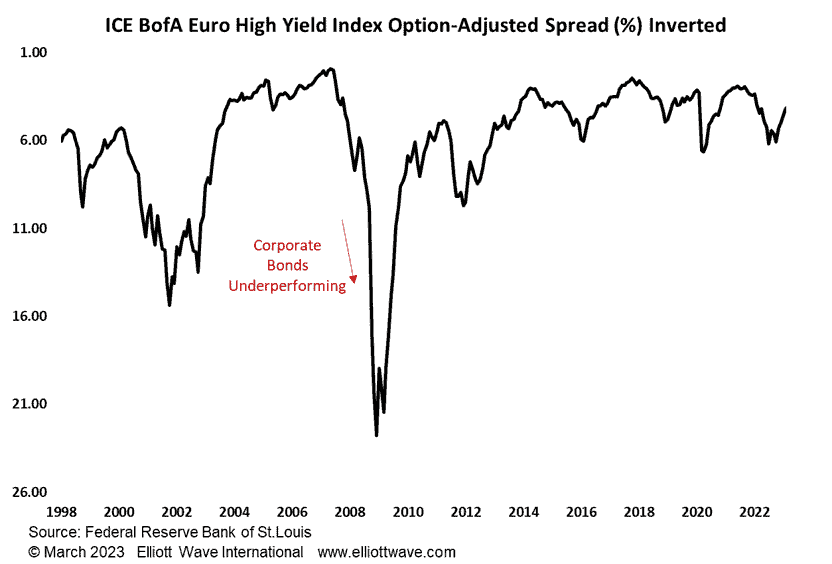

We have highlighted the fact that the corporate debt market has held up relatively well in the bond bear market thus far, but that we expected it to be the next shoe to drop. The Credit Suisse bond situation is a manifestation of that and we anticipate the disappearing confidence to drive corporate bond yield spreads wider. As the chart below shows, European corporate debt has a lot of scope to underperform.