U.K. House Price Deflation

It looks set to deepen.

The latest data on British property shows that deflation is now official. The Halifax House Price Index, a popular barometer of the health of the U.K. property market, declined by 1% on an annualized basis in May. This is the first annualized contraction since 2012 when Britain was still recovering from economic recession and the Great Financial Crisis.

The change in sentiment has been dramatic. In June 2022, the Halifax index was accelerating at a 12% annualized clip, but the combination of an emerging negative social mood and the lagging impact of rising interest rates has seen rapid disinflation, which has now turned to deflation. Judging by the share prices of a two major real estate companies in the U.K., the pressure on property values is likely to deepen.

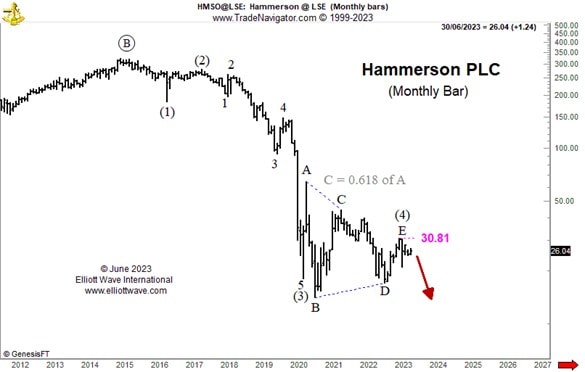

A distinct triangle pattern can be seen in the share price of Hammerson plc, a major British property development and investment company. We label that as wave (4) of a decline that started all the way back in 2015. We anticipate a decline in wave (5) to unfold from 30.81p.

Rightmove plc is the company which runs Britain’s largest online real estate property portal. Back in March 2022, we anticipated that the decline which started in January of that year was not over. Subsequent price action reveals that the decline is likely to be ongoing from 592.20p.

A protracted slump in the U.K. property market seems increasingly likely.