Powell’s Burns Moment Cometh

The Fed Chair is probably haunted by the ghost of Arthur Burns.

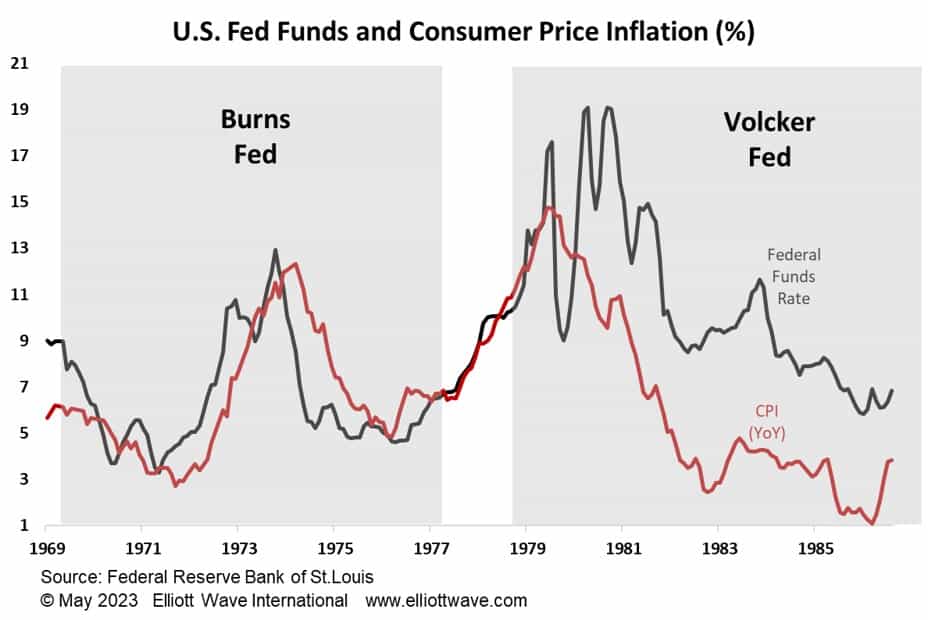

The current bout of accelerating consumer prices that we are living through has brought back analyses and debate about the 1970s and how a similar problem was solved. Credit is wholeheartedly given to Paul Volcker who, at 6 foot 7 inches tall and regularly chomping a stogie, inevitably became known as the “hard man” of Fed chairs as he raised the Fed Funds interest rate to a 20% high by 1980. Consumer prices then disinflated for decades until now.

Putting aside the fact that we do not think the Fed chair, or the Fed Funds rate can influence the waxing and waning of consumer prices to any great extent, the person in charge of the Fed two-before Volcker will probably be in the forefront of, current-chair, Jay Powell’s thoughts right now.

Arthur Frank Burns was an American economist and diplomat who served as the 10th chairman of the Federal Reserve from 1970 to 1978. The annualized change in consumer prices in the U.S. had risen from around 2.5% in 1972 to over 10% by 1974. Led by Burns, the Fed had raised the policy interest rate from 4.5% to 13% over the same period.

But then came the slump in 1974. Having peaked in 1973, the Dow Jones Industrial Average had plummeted by 46% into a low in the last quarter of 1974. Spooked, the Burns Fed cut interest rates back to below 5% and, to be fair, consumer prices started to disinflate. By 1976, though consumer prices were accelerating again, moving back above a 10% per annum clip in 1979. Enter the big man, Volcker, who sealed his legendary status by slaying the “inflation” dragon.

The historical narrative is that Burns is pilloried for cutting interest rates in the mid-1970s, in so doing fueling the subsequent re-acceleration in consumer prices. For better or worse, his legacy is of being known as “the worst chair in Fed history.”

Powell, whose approval ratings are already the lowest since the Greenspan Fed over twenty-years ago, is very likely going to face a similar situation to Burns if our Elliott wave analysis is correct, the stock market (and economy) tanks and debt deflation sets in.

What will he do? As Elliott Wave International’s subscribers are aware, the Fed will follow (not lead) what the money and bond markets are pricing in, so stay tuned to keep on top of developments.