Bonds: No Safe Haven During a Deflationary Crash

Many investors are under the mistaken notion that bonds will nearly always provide a cushion against a big drop in the stock market.

Yet, the Dow Industrials has been in a downtrend since near the start of 2022, and as I write on Sept. 23, the index is trading below 30,000 – hitting a fresh intraday low for the year.

On the same date, there was this headline (CNBC):

2-year Treasury tops 4.2%, a 15-year high as Fed continues to jolt short-term rates higher

Robert Prechter’s Last Chance to Conquer the Crash had already provided this warning:

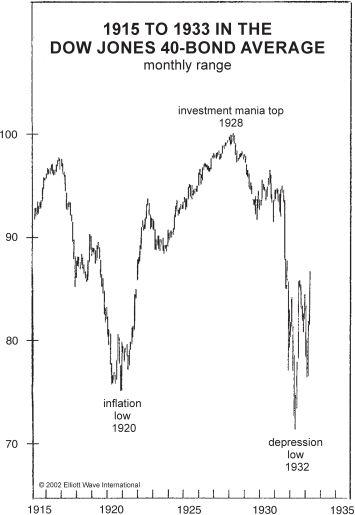

[The chart below] shows what happened to the Dow Jones 40-bond average, which lost 30% of its value in four years [in the last deflationary crash]. Observe that the collapse of the early 1930s brought these bonds’ prices below — and their interest rates above — where they were in 1920 near the peak in the intense inflation of the ’Teens. …

Conventional analysts who have not studied the Great Depression or who expect bonds to move contracyclically to stocks are going to be shocked to see their bonds plummeting in value right along with the stock market.