Debt Stress Rising

Signs of a breaking point coming.

Most people thought Ben Bernanke was joking when, in 2002, the former Fed Chair said that, in an effort to fight an economic downturn, the Fed could throw money out of helicopters. Fast forward to 2020 and that’s exactly what happened, well, metaphorically at least, when the U.S. government sent households so-called stimulus checks. Thanks to this largesse, the supply of money exploded. Then, from 2021, so did consumer price inflation. The Fed and the government seemed surprised. Seriously, what the non-fungible tokens did they think was going to happen?!

It was Milton Friedman, the most famous monetary economist, who first coined the term helicopter money and the last couple of years have proven his thesis that, “(consumer price) inflation is always and everywhere a monetary phenomenon,” largely correct. Ironically, it is the current consumer price inflation which the Fed had a huge hand in creating, that is a big reason why a spectacular economic bust is coming.

Social mood is the driver of economic cycles, and it has been turning ever more negative since the start of 2022, driving stock markets lower. At the same time, rampant consumer price inflation is causing people to turn to credit card debt to keep their heads above water. The latest household debt report from the Federal Reserve Bank of New York shows that U.S. credit card debt remained at a record high of $986 billion in the first quarter of 2023. The interesting aspect about this stat is that credit card debt historically gets paid down in the first quarter of the year. Not this year, no Sir. It’s another sign that, with the personal savings rate at historic lows, people are borrowing in order to merely exist.

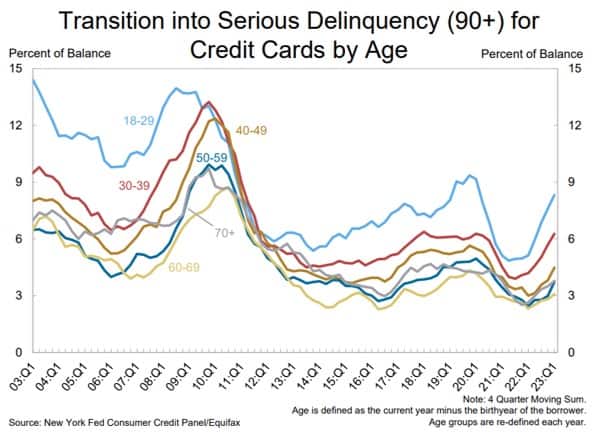

But look at the chart below. Delinquency rates (those not paying for greater than 90 days) had fallen to a record low when the stimulus checks fell from the great money gods in the sky, but they are now accelerating higher as people struggle to make payments. This is yet more evidence that a recession is coming which will probably coincide with debt deflation.