Drowning in Debt

Before a tsunami hits, the tide recedes dramatically.

Warren Buffett famously said that “when the tide goes out, you can see who has been swimming naked,” in reference to companies and investors who are over-leveraged when events turn against them. The tidal cycles on the river Thames here in England remain as predictable as they ever were, but for Thames Water, the utilities company, the tide has most definitely gone out and now the board can be seen in the altogether.

Water companies in the U.K. were privatized under the Thatcher government in the late 1980s and almost all have since been delisted and taken into ownership by private equity firms. Macquarrie Group, the Australian financial services company, took over Thames Water in 2006 and during the “free-money era” after the Global Financial Crisis, when interest rates went to almost zero, built up a humongous pile of debt.

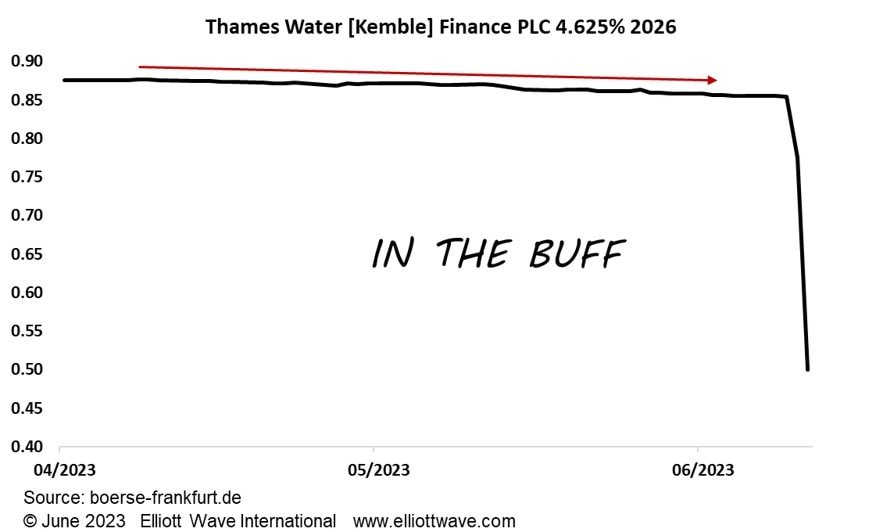

Productive debt, such as that used for investment, can be a good thing, but unproductive debt is not. Under Mcquarrie’s ownership, Thames Water used the debt to help pay out billions in dividends. The result was that by last year Thames Water was operating under a leverage ratio of 80%, meaning that its debt amounted to 80% of its capital. Now, as the tide has receded and interest rates have shot up, Thames Water is essentially bust, and the U.K. government is considering taking it back into public ownership. The chart below shows the price of one of Thames Water’s bonds, now trading around 50 pence on the pound. Notice that the price was declining relentlessly before the drama of this week, giving a warning that something was not quite right.

This is simply a classic tale of what happens when debt becomes unsustainable. Expect a tsunami of stories like this to emerge as interest rates stay high and highly leveraged companies are forced into debt deflation.