Junk Sunk as Debt Deflation Risks Rise

Corporate bonds are starting to show signs of meltdown.

Last week might have been a watershed in the corporate bond market. Up until now, corporate bonds have not exhibited any signs of stress. Sure, yields have risen a huge amount this year as the bond bear market has progressed but although corporate bonds have underperformed, they have not imploded. That might be changing.

The leveraged buyout (LBO) of Citrix Systems, Inc, the technology company, meant that the largest issuance of junk bonds this year went ahead and was closed last week. However, the sale was a disaster with one banker involved in the deal calling it a “bloodbath,” according to the Financial Times. The pink newspaper estimates that banks involved in the underwriting syndicate lost about $600 million, having to offer deep discounts on the bonds due to lack of investor demand. And still the banks are left holding a huge amount of Citrix paper on their books at far less than they agreed to underwrite it. This deal was seen as a litmus test for the health of the corporate bond market, and the result is not good news.

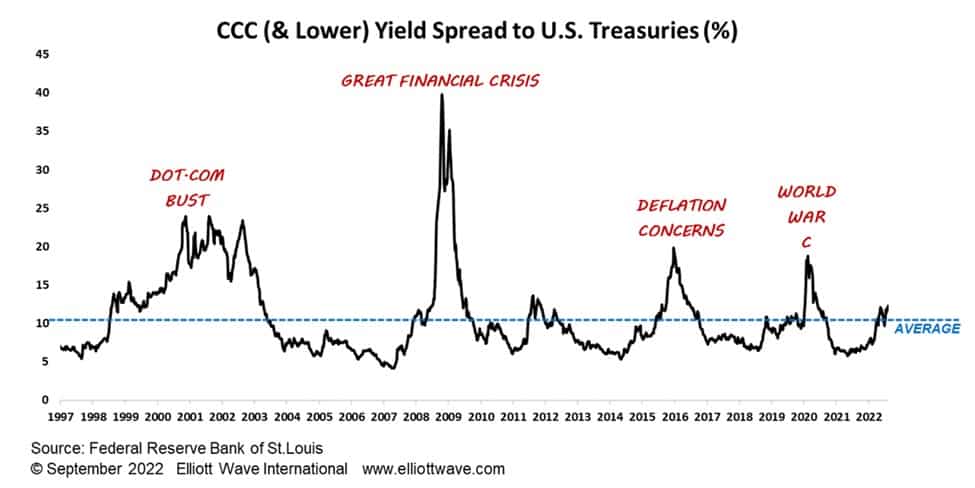

The chart below shows the yield spread between U.S. dollar denominated corporate bonds rated CCC (and lower) and U.S. Treasuries. It has been advancing since last year indicating that junk bonds are underperforming, but that trend has only brought it back to the long-term average spread since the 1990s. The yield spread has just made a new high for the year, a sign that the underperformance trend could be accelerating. As you can see from the history, if the global economy really is turning down into an historic slump, as we suspect, there is huge scope for corporate bonds to enter a panic phase. Should that happen, expect the zeitgeist to be all about defaults and debt deflation.