European Property Markets: Another Big Bust in the Making

In these pages, we’ve discussed the widespread deflation of real estate markets which appears to be developing around the globe.

A notable example is the property market collapse in China and another is the dramatic cool-off in the housing market of the U.S.

Let’s now focus on Europe. This is from The Financial Times (August 15):

European office market faces biggest test since financial crisis

Cost of servicing debt tops rental income for first time since 2007 as creditworthiness deteriorates

Elliott Wave International’s September Global Market Perspective gets into the details with this chart and commentary:

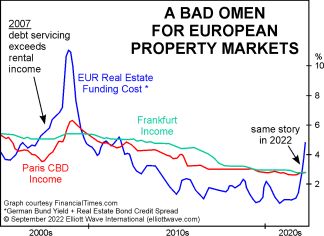

This chart [compares] real estate funding costs (yields on German bunds plus credit spreads on real estate bonds) against office income in Frankfurt and Paris.

For more than a decade, office space generated enough income to exceed the cost of raising capital. The calculus, however, flipped this year with office income stagnating around 3% and real estate funding costs pushing toward 6%. Perhaps you can guess the last time this dynamic occurred? It was 2007, a monumental year that saw peaking global stock indexes and a widespread property bust that eventually set records. This year is on a similar trajectory.