Fearing Deflation, the Lady is not for Tapering

When is a taper not a taper? When it’s a recalibration.

In October 1980, British Prime Minister Margaret Thatcher made a speech to her Conservative Party conference. Referring to criticism over her anti-inflation economic strategy (consumer prices were rising at an annualized rate of nearly 18%!) and mentioning that people were speculating on a U-turn she stated, “You turn if you want to. The Lady is not for turning.” That speech became iconic as Thatcher cemented her reputation of being “the Iron Lady” over the next decade.

Now it seems the European Central Bank President, Christine Lagarde, is wanting to set herself up as a new Iron Lady, judging by her comments yesterday. Answering a question on the ECB’s decision to reduce the amount of bonds it is buying in its monetary-inflating asset purchase program (Pandemic Emergency Purchase Program, PEPP) she said, “the lady isn’t tapering,” before adding, “…what we are doing is recalibrating PEPP.”

Ah right, I see. It has come to this. Sigh. Central banks are now so fully engaged in living on their own omnipotent planet that they think they can do one thing but at the same time say that they are not doing it. I mean, for goodness sake, the ECB is plainly reducing the amount of bonds it is buying. But we’re not to consider it as a taper of the program, just a recalibration.

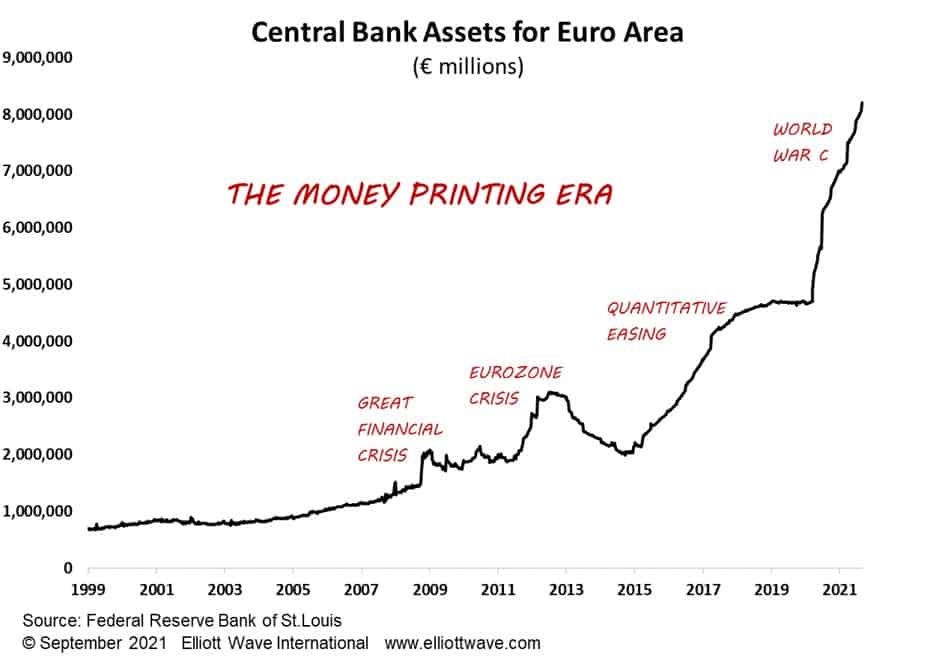

Fair enough, I get it. Madame Lagarde is wanting us to see it as what might, or might not be, a temporary reduction in bond purchases. She wants the market to understand that the ECB could easily change back to buying more bonds. This is as clear an indication as can be that the ECB views money printing as here to stay. After all, it really is the only thing left in its monetary policy locker.

In 1980, consumer price inflation in much of Europe was running rampant and the original Iron Lady was determined to get it down. Four decades later, the new Iron Lady is stressing her commitment to monetary inflation, because the biggest fear now is deflation.