2021 Inflation. 2022 Deflation Talk?

Everyone’s concerned about consumer price inflation. But perhaps that will change next year.

Supply chains. Up until the last year or so, nobody really knew much about them. But the World-War-C-inspired national and international lockdowns meant that, all of a sudden, people around the world became aware of just how interconnected the world economy has become. The factory of the world, China, effectively stopped exporting stuff and the knock-on effects have been felt everywhere. International shipping has been severely affected with freight rates jumping by a thousand percent since the pandemic began. Commodities became highly sought after and, of course, their prices naturally rose.

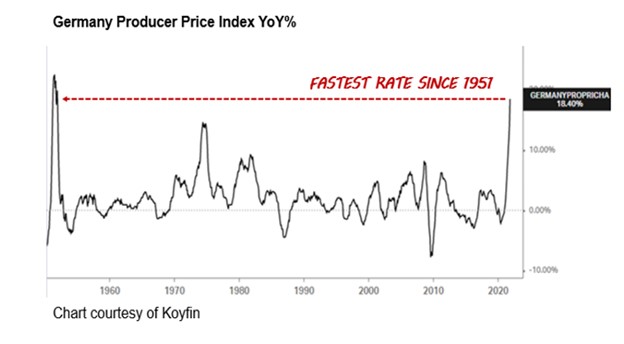

All of this has meant that producer prices have ballooned. This week, Germany released its Producer Price Index (PPI) for October, and it showed an annualized increase of 18.4%. In January this year, the rate was less than 1%. PPI in Germany is currently accelerating at the fastest pace since 1951, a volatile economic period when Germany was rebuilding having been decimated during the Second World War.

This world war, the one against Covid, is completely different of course and it appears to be, if not at the end, certainly past the beginning of the end (apologies to Mr. Churchill for mangling his quote). Thus, there is good reason to believe that supply chain snarl-ups have probably reached a peak and that the direction of travel is now for getting back to normal business practices with shipping and travel less restricted. As for commodities, whilst the Commodity Research Bureau (CRB) Index has probably started a new long-term bull cycle, the current rally is showing slowing momentum since July, a sign that a corrective decline might be coming due.

History, and the laws of mathematics, tells us that producer prices will find it very difficult to keep accelerating at the current rate. That doesn’t mean they will decline, of course, but a slowing rate of increase in 2022 seems highly likely. If that turns out to be the case, the current panic over inflation will give room for a two-way conversation about price deflation.