A Deflation Risk

Risk Parity could become an issue.

When I was working with the world’s largest sovereign wealth fund, we hired a couple of rocket scientists straight out of academia. They were literally rocket scientists with degrees in Astrophysics and the like, and we hired them to develop quantitative portfolios. They had brilliant minds but zero market experience. After a while, one of them said, “Eureka! I have found the secret sauce.” His idea was to sell (write) overnight options. 99% of the time they would expire worthless, and the fund would pick up a small return every single day. We (grizzled market vets) indulged him. We knew that the risk allocation to the portfolios was controlled manually and so, as volatility started to rise and the portfolio started to underperform, we cut the risk way down, just before the Great Financial Crisis! (Note to market newbies. Picking up pennies in front of a steamroller seems like a brilliant idea, until you slip!)

“Quants” often come up with superb ideas but, when it comes to implementing them, the reality is that they are impractical because market realities, such as liquidity, have not been thought of. Or sometimes strong relationships exist between markets which lull people into thinking that condition, like your first crush, will go on forever. An example of this could be so-called Risk Parity strategies. This is from Investopedia:

“Risk parity is a portfolio allocation strategy that uses risk to determine allocations across various components of an investment portfolio. The risk parity strategy modifies the modern portfolio theory (MPT) approach to investing through the use of leverage.

MPT seeks to diversify an investment portfolio among specified assets to optimize returns while adhering to market risk parameters by viewing the risk and returns for the entire portfolio, but only utilizing long and unmargined positions. With risk parity strategies, portfolio managers can derive exact capital contribution proportions of asset classes in a portfolio to achieve optimized diversification for a range of objectives and investor preferences.”

Nope. Me neither. If your eyes glazed over reading that you are not alone. In general, I have found that “Quants” really love to complicate things and miss the point which Einstein made that, “The definition of genius is taking the complex and making it simple.” Risk Parity is an example of this because, cutting through all the fluff, the success or otherwise of it basically depends on the correlation between stocks and bonds. The Risk Parity strategy relies on a negative correlation between the prices of bonds and stocks. As one is going down, the other should go up to compensate. When that doesn’t happen, the strategy underperforms.

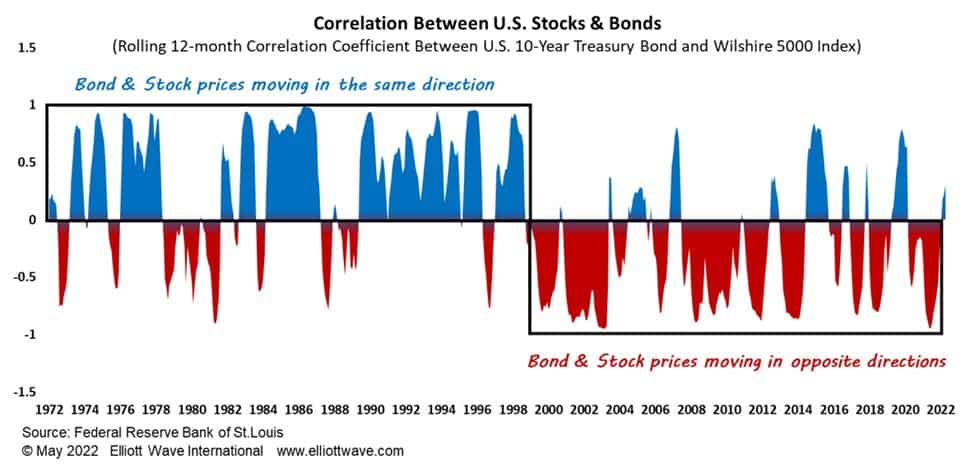

The chart below shows why Risk Parity strategies have become so popular over the past two decades. Whereas before 2000, the correlation between stock and bond prices was predominantly positive, that has flipped this century (perhaps because of a “Fed put” perception). However, so far this year, the relationship is turning positive with bond and stock prices both declining.

This is important because, if bond and stock prices continue to decline together, Risk Parity funds will be under increasing pressure to reduce exposure and sell both bonds and stocks. Selling begets selling. That might ring a bell for older readers who remember the 1987 crash and how it was blamed on “portfolio insurance.”

Thus far the rise in bond yields has not broken anything, but if history is any guide, it will at some point. Expect deflation chatter to increase when it does.