And now, it’s time to talk about deflation.

A key recession indicator is now flashing red.

Imagine you are walking in the woods one day and you get attacked by a grizzly bear. It’s a vicious, horrendous assault but you are still alive when the bear plods away. You think, “I might just survive this,” when you notice that the bear has just returned with his family to finish you off. That’s how the corporate bond market must be feeling now.

Global bonds have been decimated this year in what has been the worst bear market on many measures. However, most of that pain has come from one variable of the bond price equation – the interest rate. As bond yields rise, prices fall, and yields have risen across the board this year, accelerating a trend started in 2020 and coinciding with central banks finally relenting to demands from the markets to increase policy rates.

The other variable of the bond price equation is creditworthiness. How risky a bond is depends on the issuer of that debt and how the market perceives the likelihood of default. This is measured by the yield SPREAD between various bond market sectors. In the first few months of this year, as bond prices were being pummeled because of rising yields, corporate bond yield spreads were relatively stable, indicating that the market did not perceive much deterioration in the economic outlook. That is, up until now.

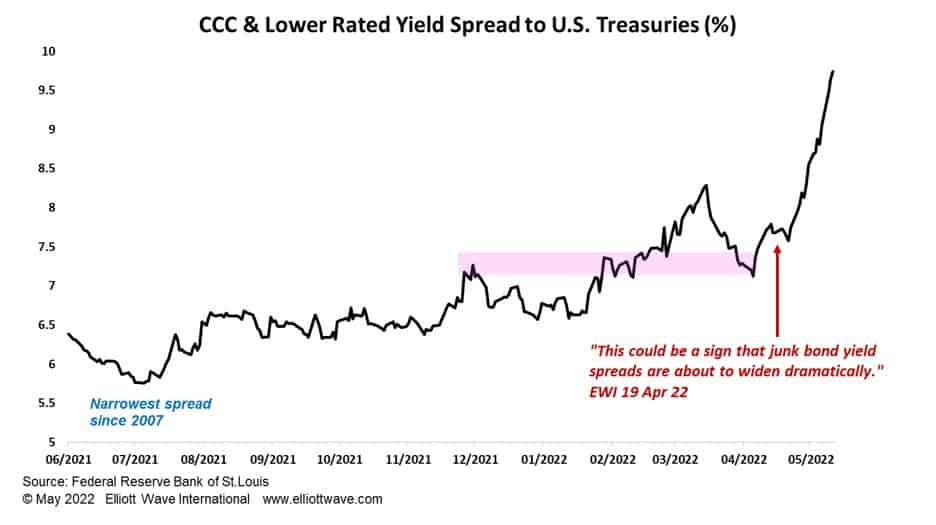

Elliott Wave International (EWI) has noted over the past few months that yield spreads such as shown below, for U.S. dollar denominated junk bonds, were edging higher and warned about an acceleration. On 19 April, EWI’s ProServices noted that the junk bond yield spread had found support at an area of previous resistance and stated, “This could be a sign that junk bond yield spreads are about to widen dramatically.”

Now that acceleration has arrived which is clear evidence that sentiment is firmly towards the risk of downgrades and defaults as the economy slows. The humongous level of debt, especially in non-financial corporates, has been well documented and some bond bulls thought that rates and yields couldn’t rise that much because debt servicing would become untenable. Well, there’s another side to that argument. That debt servicing costs do indeed become untenable and it results in debt-deflation. With another central bank bailout off the table (sigh, at least for now (roll of eyes)), debt-deflation looks increasingly like it is coming.