Boring Banks Bulging with Bonds Becoming a Bother

The bank sector might be flagging a coming deflationary issue.

A Bloomberg article caught my eye last week suggesting that the internal portfolios of bonds held by banks is a growing concern. In a nutshell, banks have huge holdings of bonds thanks, in large part, to the money printing of the Fed over the last decade. With this year’s most vicious bond bear market in history, those bond portfolios are suffering massive mark-to-market losses.

Banks have a choice whether to classify their bond holdings as “Available for Sale” (AFS) or “Held to Maturity” (HTM). AFS offers flexibility, but the bonds must be marked-to-market and losses reduce the bank’s capital base. HTM does what it says on the tin which means that those funds could not provide liquidity in the event of a run on the bank. Loan to deposit ratio analysis is not suggesting that any time soon but some, particularly at First Republic Bank, are raising eyebrows. Is there a problem brewing in the sector?

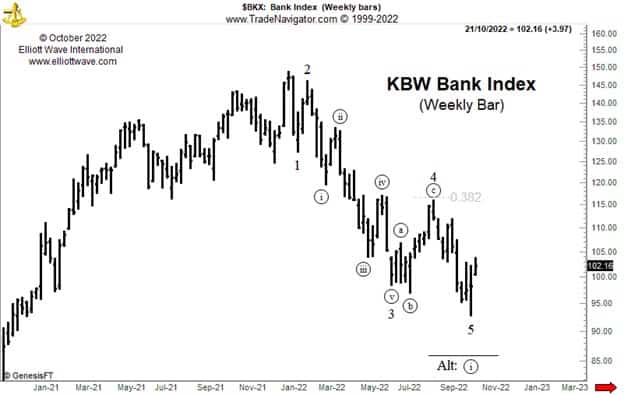

The chart below shows the KBW Bank Index, which includes 24 banking stocks representing the large U.S. national money centers, regional banks, and thrift institutions. The index topped out in January and has declined by over 30% since. Importantly, the Elliott wave structure shows a clearly impulsive decline which could have completed five waves at last week’s low. That means, after a bounce, another decline should ensue.

The decline has classic Elliott wave qualities. Wave 2 was a sharp and deep correction, and wave 4 was a shallow expanded flat (retracing 0.382 of wave 3) speaking to the guideline of alternation. Wave 3 shows a clear extension and wave 5 ended just past the level where it equaled the length of wave 1, a common relationship when wave 3 is extended.

Is there a problem with bank liquidity looming? We don’t know. All we know is that it seems quite clear from an Elliott wave perspective that the bank sector will very likely continue to decline, either after a bounce or sooner.