Cash Performance Suggests Deflation Fears

Cash has not been trash so far this year.

Inflation, inflation, inflation is all we hear about these days in the financial media, with the growth in consumer and producer prices the fastest in major economies since the 1970s. Consumer price deflation is not on anyone’s radar screen. However, it’s not labeled as such, but real deflation is happening this year with the looming contraction in central bank balance sheets. Contracting the amount of money in the economy is deflationary and, if social mood turns negative as we expect, credit contraction will also be starting this year.

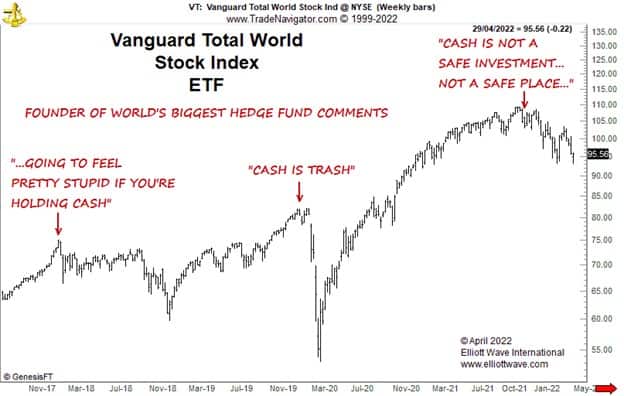

The “inflationistas” are no doubt scratching their heads when examining some asset class returns. When consumer price inflation is rampant the conventional way of thinking is that cash is a bad asset to hold. This is because its real value will diminish as consumer prices rise. This sentiment was captured by us in December last year when we showed the chart below. Headline-grabbing comments on the futility of holding cash have now coincided with three significant tops in global equity markets.

In nominal terms, the 10-year U.S. Treasury bond has declined by 10% in price terms this year. The global equity market index is down by 11%. Bitcoin (a supposed inflation hedge) has declined by 14%. When adjusted for consumer price inflation, these declines will be even greater.

What about cash? Although its nominal performance is positive (enhanced a wee bit by rising money market rates) in real terms, of course, it is negative. However, it still beats the performance of bonds, equities and Bitcoin by a long way. Indeed, EWI has long held the view that the proper way to measure a return on cash is to turn the charts of other asset classes upside down. A falling equity market, for example, will show that the value of cash is going up. Doing that in relation to the three other asset classes mentioned would mean that cash is sporting a positive return for this year.

Now, to be fair, the two classic “inflation” hedges of commodities and property have both performed very well this year and so that fits with classic conventional thinking. However, the fact that the relative performance of cash is holding in suggests to us that perhaps the stock market is looking around the corner and seeing deflation ahead.