Central Banks Buying Record Amount of Gold

Is a new Gold Standard coming? That would involve deflation.

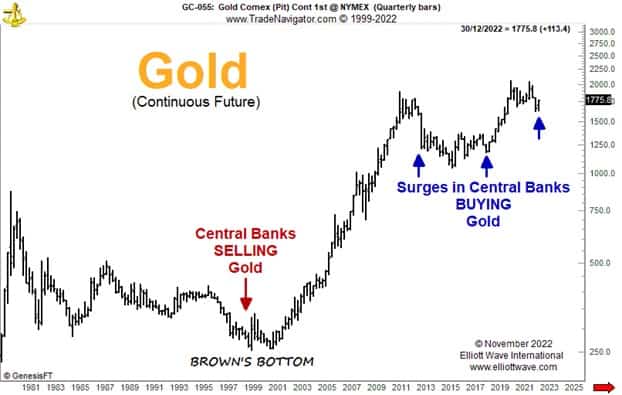

Central banks bought 400 metric tons of gold during the third quarter. That’s the largest of any quarter in data going back to 2000 and close to the normal amount central banks would usually buy over an entire year. What’s going on?

Most of the buying this year has come from central banks in emerging markets, Turkey, India, Uzbekistan, Egypt and Iraq in particular. There are probably a number of reasons for this. Some of these countries are in economic turmoil and could be boosting their gold reserves in order to provide confidence to foreign investors. Another reason could be that some countries are spooked by the seizure of Russian foreign currency reserves earlier this year and want a bigger stash of gold which can’t be seized by foreign powers. Another reason could simply be that central banks are bullish on the price of gold.

It’s often asserted that central banks and governments are usually late to the party when it comes to trends in financial markets. That’s largely true, particularly with regard to legislation which is very often passed at precisely the wrong time, such as loosening regulations at the top of an economic cycle and tightening them at the bottom. Governments have a history of closing that barn door as they watch Trigger gallop off into the sunset.

When it comes to gold holdings, a number of European central banks famously sold large amounts of the metal in 1999 and 2000, just as the gold price was establishing an historic LOW. The U.K., at the behest of the then Chancellor of the Exchequer, Gordon Brown, was particularly aggressive in offloading its gold reserves at that time, prompting the historic nadir to be affectionately known as “Brown’s Bottom.” So, does the record central bank buying now point to a high in the gold price?

A surge in gold buying by central banks came between 2011 and 2013, just as the gold price was registering a peak. However, another surge came in 2018 and 2019 which didn’t coincide with a high. Indeed, according to the World Gold Council, this year’s pace of gold accumulation by central banks is the fastest since 1967, just before the Bretton Woods monetary system collapsed and the price of gold surged. Perhaps, then, rather than wondering whether the central bank buying is an indication of a peak in the gold price, we should be asking ourselves whether a new monetary order is lurking around the corner.

With geo-political instability growing rapidly, that might well be the case.