Commodity Price Deflation Round the Corner

This too shall pass.

Ralph Nelson Elliott discovered the Wave Principle after conducting empirical research on U.S. stock market data. One of his key findings was that third waves in a stock bull market very often tend to be strong (extended, in the Wave Principle vernacular). This fits with the personality of waves researched by Frost and Prechter because it is during the third wave of a bull market in stocks that the “news” starts to turn positive and participation in the advance broadens. The underlying sentiment is one of greed.

When it comes to commodities, though, a different dynamic is present. When commodity prices ramp up, it is very often driven by the emotion of fear. The fear of producer and consumer price inflation is often a huge force behind advances in raw materials such as steel, oil and copper as well as foodstuffs such as corn and wheat.

Thus, whereas in stock market advances, it is very often the third wave of an advance which is extended, in commodity markets, it is regularly the fifth wave which is extended. Knowing this can give us an edge because when a fifth-wave advance is extended, it often ends around the level where its length equals a Golden Ratio 1.618 times the length of the advance from waves one through three.

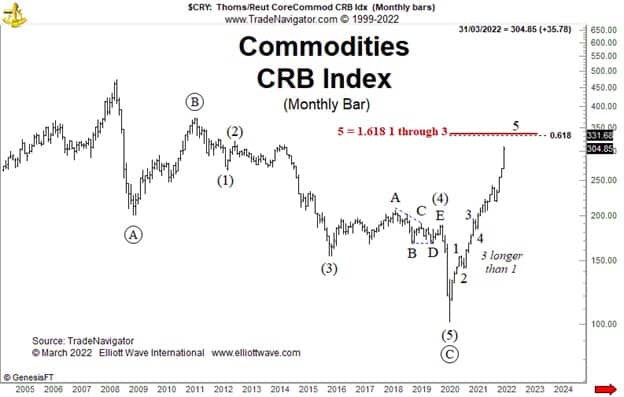

The chart below shows the Commodity Research Bureau (CRB) index and its incredible advance from 2020 after completing a 12-year bear market. In this count, wave 3 is just longer than wave 1, thereby fulfilling the Elliott Wave rule that wave 3 cannot be the shortest of waves 1, 3 and 5 of an impulse. Using this count, wave 5 is extended and the level where it would equal 1.618 times the length of waves 1 through 3 comes in at 335 on the CRB index. Curiously, that level is just above 331.68, where the advance would equal a Golden Ratio reciprocal 0.618 retracement of the entire decline from 2008 to 2020.

This points to the zone between 331 and 335 in the CRB index as having a high probability of being where the advance from 2020 will end and a decline (perhaps a sharp one) will begin.