Consumer Price Deflation Distant

The Fed faces a stickier situation since Sticky the stick insect got stuck in a sticky bun.

The latest consumer price inflation data from the U.S. showed a continued disinflation in the annualized rate, something which financial media at least thinks gives a sense of relief to financial markets because it might encourage the Federal Reserve to ease off on its program of interest rate hikes. However, there could be emerging evidence that higher consumer prices are sticking.

The Federal Reserve Bank of Atlanta’s Sticky-Price Consumer Price Index (CPI) series is designed to capture the price changes in goods and services that change price relatively infrequently. The aim is to see if rising consumer prices can be considered temporary or something that has been ingrained into the economy. For example, a 2004 study found that motor fuel prices changed on average every three weeks and women’s apparel prices every two months, whereas alcoholic beverage prices changed every seven months on average and medical care services every fourteen months. If higher prices are sticking, it could become an issue for the Fed.

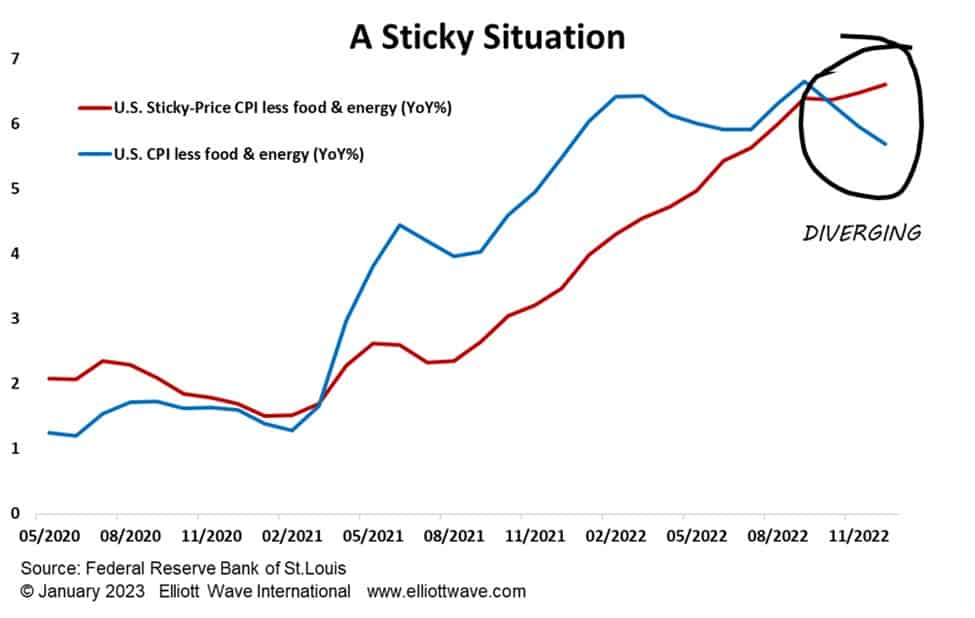

The chart below shows that over the past two data points (November and December) the rate of growth of core-CPI in the U.S. (CPI less food & energy prices) has slowed, whereas growth in the equivalent Sticky-Price CPI is accelerating. Notice that a similar divergence was occurring between April and July last year.

This divergence presents a dilemma for the Federal Reserve when deciding how much to hike rates at its next meeting at the end of the month. It might mean that they hike by 50-basis points rather than the 25-basis points which the market now expects.