Corporate Crash Coming with Debt Deflation

Would you rather invest in T-Bills or corporate bonds?

The days of TINA (there is no alternative), when short-term interest rates were essentially zero and people thought the only option available was to invest in the stock market, are long gone. With the Federal Reserve being led by the bond market into raising its official Fed Funds policy rate by 425-basis points (4.25%) since January 2022, investors can now earn a juicy return (compared with recent history that is) in U.S. Treasury Bills with, in theory, no risk.

You can currently earn around 4.50% by investing in a 90-day T-Bill, lending your money to the U.S. government which will always (so it says!) pay you back. Compare that with what you can earn by lending your money to corporate borrowers. The yield on an index of BBB-rated corporate bonds, the lowest quality of what is considered to be “investment grade” bonds before you get to junk bonds, is currently around 5.40%. The additional 0.90% you get is compensation for taking the extra risk of lending to borrowers which have a much higher probability of default. Sounds normal, right?

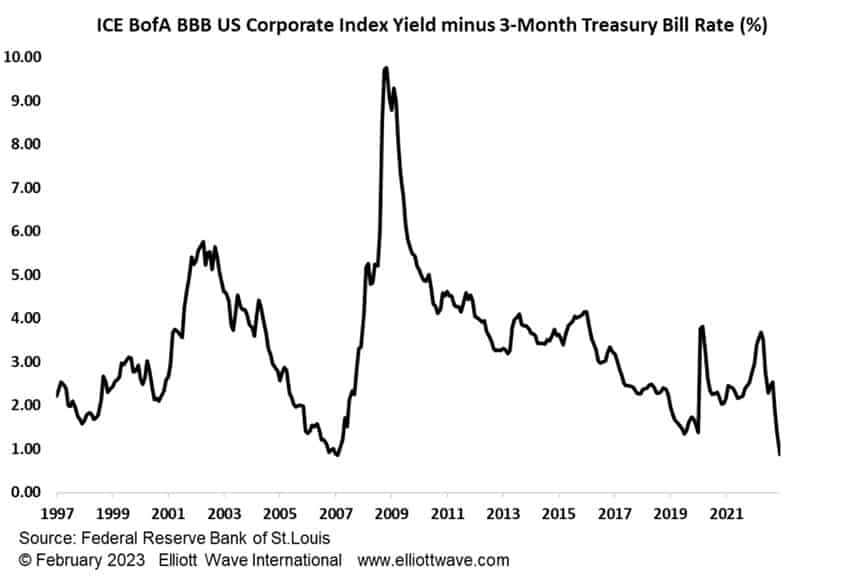

Well, yes, until you consider that the average extra yield you can earn on BBB bonds as opposed to T-Bills is 3.30% since 1997.

The chart below shows the yield spread between BBB-rated bonds and 90-day T-Bills. As you can see, it is the skinniest yield spread since 2007, just prior to the Great Financial Crash when corporate bond prices crashed, and yields soared.

In fact, Bank of America has looked at this yield spread going back to the 1920s and found that the current yield compensation equates to lows seen in 1929, 1966, 1973 and 1979. All times either just before or coincident with above average financial market turmoil.

Will this time be different? We don’t think so.