Credit Deflation

The motor of the economy has stopped.

Two reports on Bloomberg caught my eye this week. Firstly, U.S. home foreclosures have now increased on an annualized basis for 23 straight months, as the housing market comes to terms with the unprecedented rise in interest rates over the last couple of years. Secondly, auto repossessions are booming as consumers fall behind on loan payments. In a stark reminder of the phrase, “there’s always a bull market somewhere,” the report describes the optimism and ebullience at the North American Repossessors Summit, held near Disney in Orlando and with the stomach-churning strapline, “Putting the Magic Back in Repossessions”. Seriously. Check it out at reposummit.com.

Everywhere you look now, higher interest rates are beginning to bite. It seems increasingly likely that another round of bank consolidation is underway in the U.S. with many regional banks facing difficulties. The U.S. is unique in the world by having well over three thousand banks whereas most countries have less than three hundred. Smaller banks are losing deposits and people are moving to the big players. Mergers and closures seem inevitable, and that has an effect on the availability of credit. The decision to fund a tech venture capital firm, being made by SVB a few weeks ago, is now in the hands of an official at HSBC, a potentially very different model. Everyone in the market seems to be getting excited about the next Loan Officers Survey from the Fed due out next month but we don’t have to wait for that to recognize that the credit crunch is already in operation.

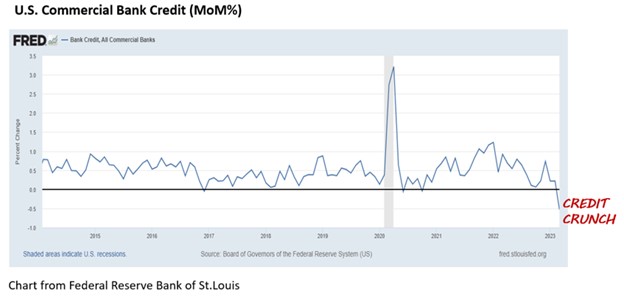

The chart below shows that U.S. Commercial Bank Credit is now contracting. The last time credit deflation was this extreme was during the Great Financial Crisis of 2008-09. Given that, in Elliott wave terms, the current bear market is probably one degree larger than that episode, do not be surprised if this contraction in credit persists.