Debt-Deflation Looms in U.K.

We’re doomed, I tell ye. Doomed!

Sentiment is so gloomy here in the U.K. that I can’t help but think of Private Fraser’s catchphrase in the iconic British comedy, Dad’s Army. With a totally chaotic government (which next week will be introducing spending cuts and tax rises), panic about being able to stay warm this winter amidst massive energy price hikes, and public sector strikes (nurses have just voted to strike for the first time in history), the British public is staring a winter of depression in the face. The only bright spot for some people is that a serving politician from the government benches is appearing in a reality TV game show which involves grizzly and humiliating trials (such as eating kangaroo private parts). As I heard someone say this week, it feels very colosseum, with the public as the Romans watching a Christian being eaten by a lion. Dark entertainment for dark times.

The latest Gross Domestic Product figures for the U.K. were released today and they show that the economy shrank in the third quarter, paving the way for, as the Governor of the Bank of England has warned, the “longest recession since the 1920s” (joy to the world and Christmas cheer to you too, my good Sir). The U.K. housing market is slowing down very quickly with buyers taking fright from the rapid and large increases in mortgage rates this year. Elsewhere, there are signs that debt deflation is coming. The corporate sector is facing much higher borrowing rates in the bond market at a time when the economy is contracting, a recipe for increased downgrades and defaults. And the consumer is scaling back rapidly.

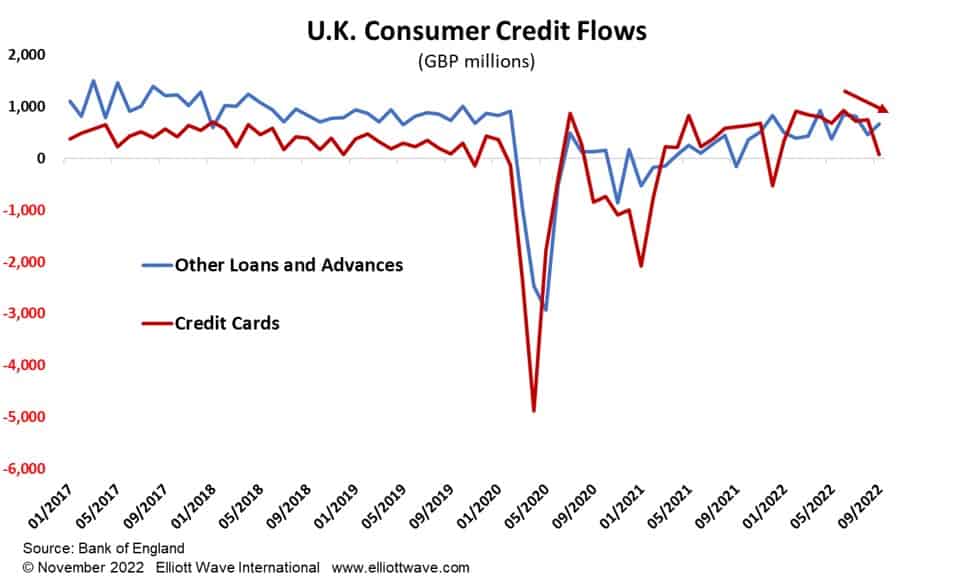

The chart below shows the flow of U.K. consumer credit as compiled by the Bank of England. A positive net flow means that households are increasing their consumer credit holdings; a negative flow shows that, overall, they are repaying credit. Flows appear to be declining with credit card loans about to move into deflation mode. As the U.K. economy sinks deeper into recession, we fully expect debt deflation to grip the nation.