Debt Deflation Risks Increase

The private sector debt burden continues to grow.

The explosion in debt since the early 1970s, when developed economies finally ended all currency links with gold, has been the source of much doom-mongering since the 1980s. A whole industry has sprung up predicting economic Armageddon when the debt bubble bursts. And yet, the debt bubble has continued to grow and grow.

Some now question whether it is even a bubble. Debt, they say, is a natural part of life. We can’t get through our lives without incurring some debt, such as a mortgage, and companies cannot expand without borrowing. This is true. Debt should not be a problem in the normal course of events. The issue becomes a problem when debt becomes excessive. The trillion-dollar question is, of course, how to define excessive.

One way is to look at the level of debt with regard to your income. On a macro-economic scale that would involve looking at debt as a percentage of gross domestic product. The other important element of macro debt examination is to break it down into public sector and private sector. Public sector debt is much less relevant than private sector debt because, in most cases, governments can defer the day of reckoning and continually kick the can down the road. The private sector doesn’t have that luxury.

Private (non-financial) sector debt in Japan inflated from 150% of GDP in 1981 to 210% at the end of 1989, according to data from the Bank for International Settlements (BIS). Then, as social mood turned negative, driving the stock market lower, it deflated back to 160% by 2007, accompanying a slump in the Japanese economy.

There are many ways to slice and dice debt statistics. Using the same BIS data, private (non-financial) sector debt in the United States of America currently hovers around 165% of GDP. That is well below the extreme that Japan reached in 1989, but it is comparable with the U.S. record high reached in 2007, just before the Great Financial Crisis of 2008.

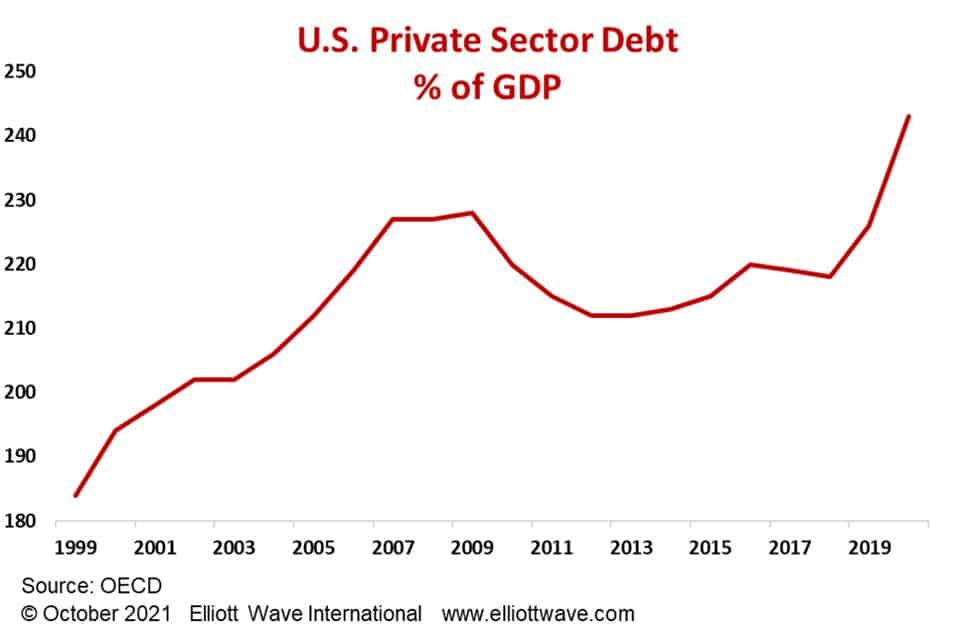

Taking private sector debt as a whole, updated data from the Organization for Economic Co-operation and Development (OECD) reveals that private sector debt in the U.S has inflated from 184% in 1999 to 243% in 2020.

You can take your pick but, under any measurement, the level of private sector debt in the U.S. is elevated. However, is it a problem?

Private sector debt only becomes a problem when social mood turns negative, as was the case with Japan. How do we know when social mood is turning negative? When the stock market develops a declining trend. Then, and only then, will the debt doom-mongers finally have their day in the sun.