Debt-Deflation Risks Rising in Eurozone

Bankers are becoming ever more cautious.

Robert Prechter’s socionomic theory asserts that it is the trend in social mood that causes social actions, whereas conventional thinking assumes that social actions cause a reaction in social mood. This flipping of causality is most appealing to free thinkers because it questions the status quo, but it also makes us really think about what is going on. For example, conventional thinking would assert that war causes people to be angry whereas the socionomic way of looking at the world would assert that it is angry people who cause war. Similarly, most people are led to believe that recessions cause businesspeople to be cautious whereas a socionomist would state that it is cautious businesspeople who cause recessions. This isn’t just semantics because the trend in social mood can be measured.

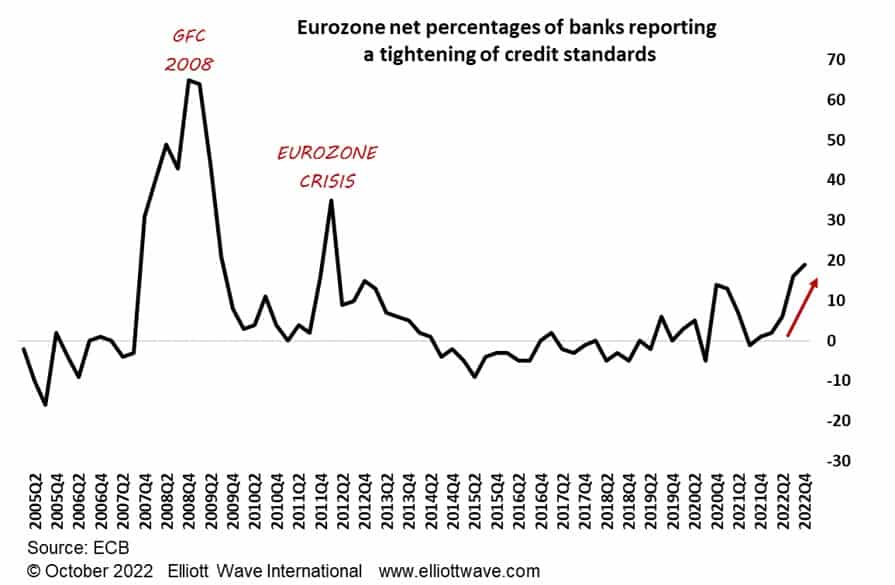

Eurozone stock market indices have declined this year indicating that the trend in social mood is negative. This trend towards ever more caution can be seen in the chart below, from the latest Euro Area Bank Lending Survey released by the European Central Bank. It shows that a net 19% of banks are tightening credit standards, up from a neutral zero at the end of last year, meaning that banks are becoming more cautious about lending. That dynamic also comes through in European corporate bond yield spreads which have been on a rising trend since 2021.

The chart shows that there is scope for many more banks to tighten credit standards and this is what we anticipate as social mood continues to trend negatively. As credit conditions become ever tighter, expect defaults to rise and debt to deflate.