Deflation Begins in the Eurozone

It’s a deliberate policy at this juncture.

Inflation is rising prices and deflation is falling prices, right? Wrong. Unfortunately, we’ve become so used to using these definitions that we have lost sight of the true meaning of inflation and deflation. As the economist Milton Friedman famously stated,

“Inflation is always and everywhere a monetary phenomenon, in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output.”

It’s an increase in money and credit in an economy which constitutes the true meaning of inflation. Vice versa, when money and credit is decreasing, that is deflation. Central banks and governments can influence inflation and deflation by their monetary policies, of course, but it’s more than that. Positive and negative social mood trends will determine the demand for credit, bringing excessive leverage in positive trends and debt deflation in negative. The broadly positive mood trend of the past 50 years has spawned a situation where global debt has inflated to two and half times the size of the global economy. The nascent negative mood trend now underway should see that deflated in coming years.

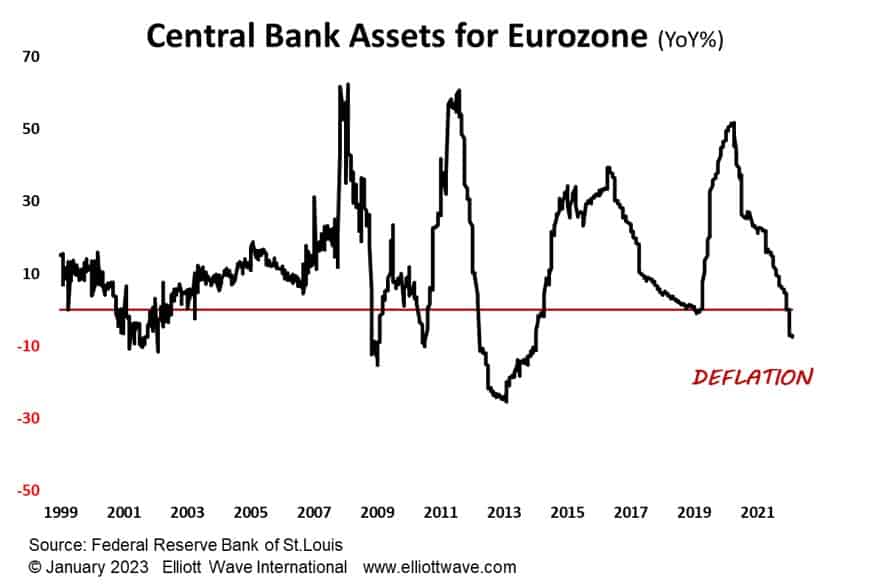

Reflecting this sea change in the global zeitgeist, central banks are now enacting policies of deflation. The chart below shows that the European Central Bank’s balance sheet (its assets in the form of bonds) is now deflating on an annualized basis. What this means in practical terms is that new central bank money is now not being printed out of thin air, as it was during Quantitative Easing, and that will have an impact on liquidity in the financial markets as well as credit creation in the economy.

When stock markets turn down again, as we expect, deflation of credit should start to gain attention.