Deflation Coming to a Property Market Near You

Bubbles are deflating all over the planet, and property is no exception.

Since the Great Financial Crisis ushered in the era of free money a number of asset classes have benefitted from that monetary inflation. Property, in particular, has seen bubbles develop in most developed countries with Canada, Sweden and New Zealand leading the way, but Germany, the U.S. and U.K. also seeing surging prices. With interest rates now on the rise, these bubbles are showing signs of popping.

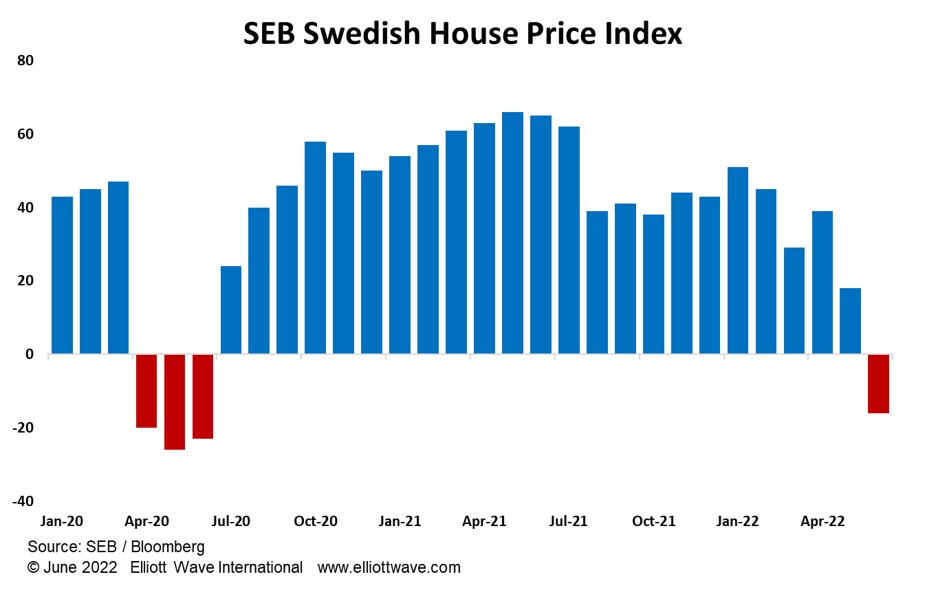

The chart below shows the SEB Swedish house price indicator, with the data showing the steepest decline since the Covid pandemic lockdowns in 2020. The change in sentiment towards property in Sweden has been swift and shocking to some, with the top real estate broker in the country describing it as akin to the post-Lehman Brothers bankruptcy in 2008. Confidence can disappear very quickly and when household debt is running at above 200% of household income, as it is in Sweden, the ramifications could be extremely ugly.

It’s not just Sweden, though. The New Zealand house price index peaked in November last year and Hong Kong, another property bubble, has been trending down since September. Property prices in Canada, the U.S. and the U.K. are still currently making new highs, but the engines are showing signs of spluttering as all three countries tighten monetary policy. In the U.S., mortgage rates have ballooned, and housing starts plunged 14% in May to the lowest level in over a year. In the U.K., the BBA Mortgage Rate is set to rise to 4.50% after the Bank of England’s rate hike last week. That would make the cost of a U.K. mortgage 25% higher than in November last year.

These are all warning signs that property markets could be keeling over and, with many people leveraged up, it might not be long before debt-deflation starts to be seen.