Deflation Fights Back

An interesting development in the ETF space.

I love the Irish and their famous logic. When I was a young lad at university, an Irish friend of mine (Andy) had an affair with another friend’s (Nick) girlfriend. Andy and Nick agreed to meet in the pub to “talk it out.” On meeting, no initial words were exchanged and Andy (the offending party) promptly floored Nick with a right hook. When the ensuing bar fight ended, I asked Andy why he had punched Nick straight away when it was himself who was in the wrong. In his broad Irish accent he said, “Well, you see, I wanted to get my retaliation in first.”

This memory was brought to my mind after reading that an Exchange Traded Fund (ETF) has just been launched which seeks to benefit specifically from deflationary conditions. As far as we know, it is the first deflation-focused ETF pertaining to the U.S. economy. The Quadratic Deflation ETF (ticker BNDD) is “an ESG fixed income ETF that seeks to benefit from lower growth, deflation, lower or negative long-term interest rates, and/or a reduction in the spread between shorter and longer term interest rates by investing in US Treasuries and options,” according to the KFA Funds website. (From our point of view, a better deflation strategy would be shorting stocks and junk bonds, when the time is right?). Quadratic Capital LLC’s Nancy Davis, who will manage the fund, has enjoyed success by launching the Quadratic Interest Rate Volatility and Inflation Hedge ETF (ticker IVOL) in 2019. Being mostly invested in Treasury Inflation-Protected Securities (TIPS), returns have been stellar, relative to the industry, although in reality, they would have done next-to-nothing to actually protect one against widespread surging prices. But in the institutional world, it’s ok to lose money so long as your neighbor loses more. But I digress. So why the flip?

Well, nothing gets launched unless there’s at least some demand and the new deflation ETF raised $3 billion. The marketing blurb talks about the U.S. economy becoming like Japan and the fact that the massive debt mountain will be a burden on economic growth. Of course, from the fund manager’s point of view, having a deflation vehicle to sit alongside an inflation vehicle makes business sense.

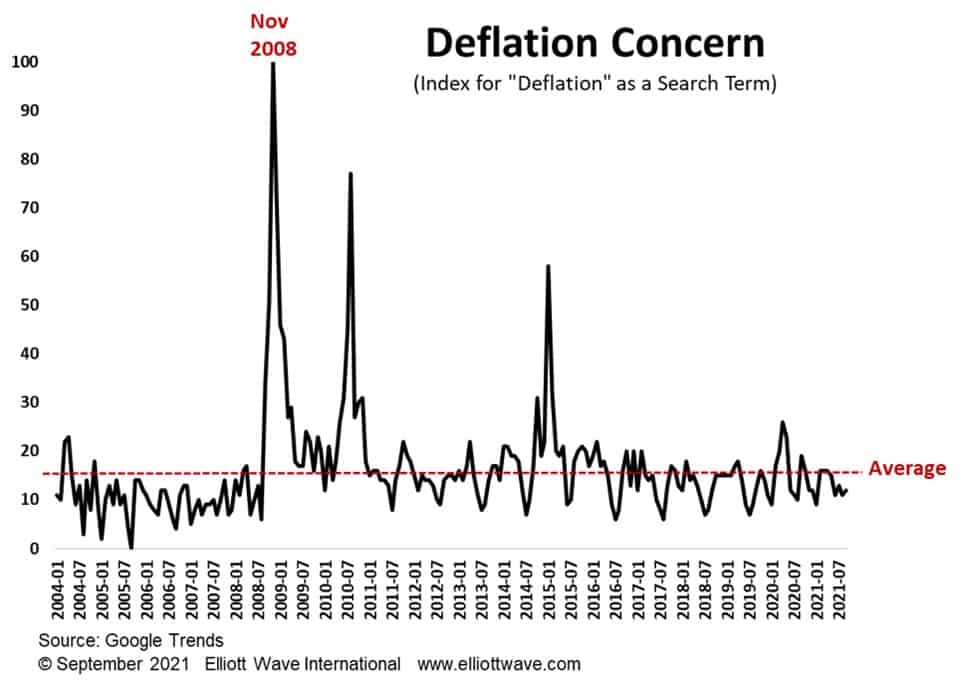

However, as socionomists, we are always intrigued by the timing of news and events. This is what makes the launch of BNDD intriguing because deflation is most assuredly not the current zeitgeist in the financial markets. Using monthly data going back to 2004, Google Trends reveals that the search term “deflation” currently sits at an index level of 12 (between 0 and 100). That compares with average of 16.2 and high points of 100 in November 2008, 77 in 2010 and 58 in 2015. Heck, not even the historic stock market crash in March 2020 could get this index above 26.

So, what are we to make of this interesting development? It might be that there is a growing awareness of deflation which is brewing but has yet to develop into a trend because everyone is focused on inflation. In that sense, the deflation ETF could be akin to getting a retaliation in first. We will be very interested to see how popular BNDD becomes.