Deflation of Demand

We’re all checking our costs.

My mother will be 80 years old next year and she is still as sharp as a butcher’s knife. Her father, my grandfather, was a policeman in the City of London and, during World War 2, stopped Winston Churchill’s car on London Bridge in the midst of a blackout because its headlights were on (a story for another time). Born in 1943, my mother’s generation was raised with an acute awareness of the fragilities of life. Because of that, an inner discipline pervades. Not trusting “this new-fangled internet banking stuff,” to this day, once a month, she sits down and writes out (by hand) a balance sheet of the household outgoings and incomings. She knows exactly, to the penny, what’s being spent. (Take care of the pennies and the pounds take care of themselves, is an old Scots maxim).

This is something we’re all thinking of doing now. With rampant consumer price inflation, the day-to-day cost of living for the vast majority of people is the over-riding issue at this juncture. Petrol (gas) prices, especially, are fast becoming the focus of everything.

Are you re-considering a driving trip? Are you trying to cut down on how much you use your car? I know I am.

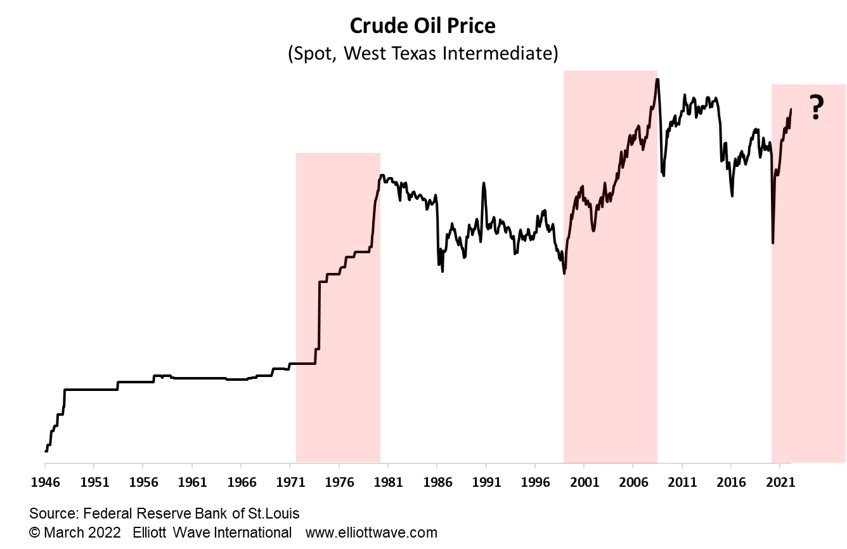

People say that spikes in crude oil prices, because they deflate consumer demand, precede economic recessions. There’s some truth in that but it’s not infallible. What is clear though, regardless of what drives what (you know our opinion), as the chart below shows, is that the two periods in history since World War 2 when crude oil has trended higher have been associated with a bear market in stocks or instability eventually manifesting in a crash.

Don’t expect this time to be any different.