ECB Insists on Deflation

This lady is not for turning.

Elliott Wave International wrote last week that Jay Powell of the U.S. Federal Reserve was being seen as “the Grinch” this Christmas because he was so hawkish at Wednesday’s press conference. Well, Christine Lagarde on Thursday channeled her inner Krampus, the horned, anthropomorphic figure in the Central and Eastern Alpine folklore of Europe who, during the Advent season, scares children who have misbehaved. And, boy, did Lagarde scare the markets.

At least, that’s what the conventional media narrative is. The European Central Bank (ECB) raised rates by 0.50% whereas the previous hike was 0.75% but President Lagarde was at pains to point out that it should in no way be seen as a sign that the central bank was about to stop raising rates. Consumer price inflation is still a very real threat as far as the ECB is concerned and so it will continue on its path and won’t be pivoting any time soon. Some financial media commentators were visibly shocked by her tone. One economist stated, “This is the most hawkish ECB press conference we’ve ever covered. Lagarde was a woman on a mission today.”

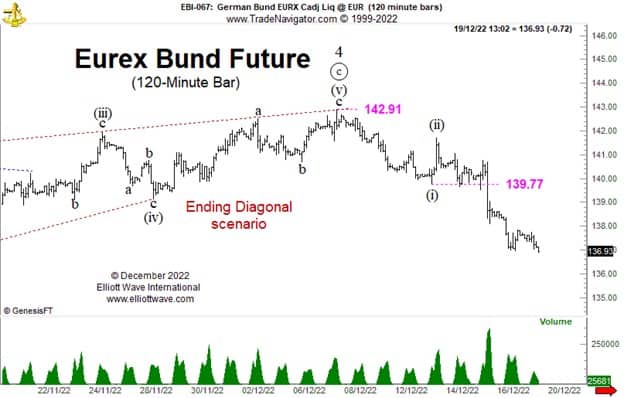

Bond yields surged as Lagarde spoke, a lay-up for conventional media to attribute cause and effect. But EWI subscribers will know that bonds were already exhibiting bearish price action. The chart below shows the 10-year Euro-Bund futures price and the Elliott wave labeling we have been highlighting for the last couple of weeks. The ending diagonal scenario we saw to complete the upward correction in wave 4 was a strong clue that the subsequent decline had a good chance of being dramatic. Indeed, on Monday 12 December the European Short-Term Update stated:

“If the ending diagonal scenario is correct, the decline should be swift.”

Should our analysis be correct, Eurozone bond prices will continue to decline (yields rise), also accompanied with the deflation of the ECB balance sheet. Whether the rise in consumer prices starts to decelerate is a moot point, but the ECB is clearly pursuing a policy of monetary deflation.