ECB On Course for Deflation

It’s gradual, but it’s coming.

The European Central Bank (ECB) held its monetary policy meeting this week and, at the press conference yesterday, President Lagarde came under fire from journalists. Consumer price inflation is elevated in the Eurozone, but the ECB is resolute in its stance that it will not be hiking interest rates this year. The plan is to end its asset purchase program first and only then consider tightening monetary policy via its policy interest rate.

The ECB’s balance sheet has swollen in the money printing era. From less than €1.5 trillion in 2008, it has ballooned to €8.6 trillion now as the bank has sought to inflate the Eurozone out of the Great Financial Crisis, the Eurozone Crisis and World War C (the Covid pandemic). As with other central banks like the U.S. Federal Reserve and the Bank of England, it has boxed itself into a corner. Whether right or wrong, the perception is that the bond and stock markets are now hooked on central bank money printing and liquidity. The ECB is terrified of what might happen when it is taken away.

Nevertheless, with consumer price inflation where it is (at 5% in Germany, the fastest clip since 1992) central banks like the ECB have nowhere to hide and are, somewhat reluctantly it seems, having to tighten policy. With regard to the ECB’s balance sheet though, there is already evidence of disinflation, which is a precursor to deflation.

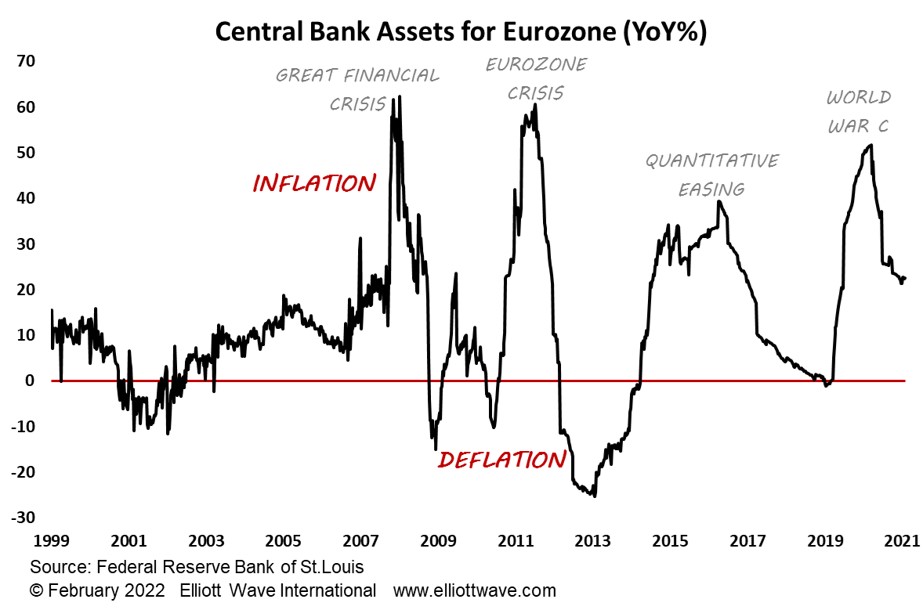

The chart below shows the annualized rate of change in the ECB’s balance sheet (aka money printing). It peaked at an inflation rate of 51% (hyper-inflation anyone?) in March last year but has since dropped to a milder (!) 22%. And they wonder why consumer price inflation is elevated? It’s interesting to note that this inflation by the ECB hit a lower peak than the greater-than-60% achieved in response to the Great Financial Crisis and the Eurozone Crisis. Both of those episodes of rampant inflation resulted in eventual deflation, and we expect this time to be similar.

You won’t hear the ECB (and other central banks) state as much, but when it reduces its balance sheet, it is engaging in a policy of deflation.