Eurotrash Signals Debt Deflation

European junk bonds are leading the way into recession.

During the 1990s and into the noughties, as the grand European project arguably peaked with the birth of the euro currency, one television show captured the zeitgeist of the time. “Eurotrash,” was a show in English broadcast in the U.K., featuring entertaining stories from around western and central Europe. The hosts were young, from France and other places on the continent, and very flamboyant. If you adored the optimism of the time to be part of the European family, you loved the show. If you didn’t, you hated it. Plus ça change, plus c’est la même chose!

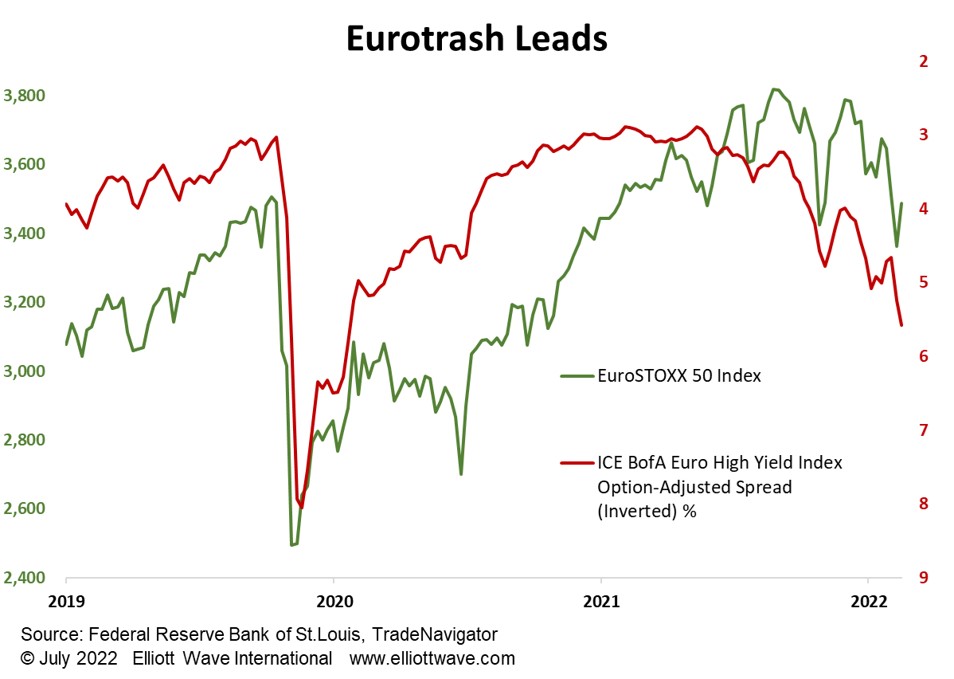

The trashiest part of the European corporate bond market continues to signal that a spiral into debt deflation is increasingly probable. The chart below shows the ICE BofA Euro High Yield Index Option-Adjusted Yield Spread, in red, as an inverted scale. When the line is going up, it signals that junk bonds are outperforming government bonds, and vice versa for when it is declining. The green line is the blue-chip Eurozone stock index, EuroSTOXX 50. Corporate credit and stocks are very closely related, of course, and so it’s no surprise that a relationship exists between them.

Notice how both lines plunged in early 2020 as the Covid-related economic lockdowns were imposed. In more normal times, corporate credit often starts to show signs of deterioration before stock markets follow, and this is what has occurred over the past year. European junk bonds started to underperform from September last year whereas the EuroSTOXX index didn’t peak until January.

As we move into summer, it appears that the underperformance of corporate credit is accelerating and so we should anticipate the same in Eurozone stock markets. That would certainly be consistent with some of our Elliott wave analysis.

German unemployment unexpectedly increased in June, and this could be the first tangible sign that the engine of the Eurozone economy is spluttering. The next stage should be a rise in corporate default rates and a lurch into debt deflation. Should that be the case, it will put huge pressure on the foundations of the European project. We won’t be surprised to see much more gloomy and satirical shows about Europe on our television screens in the future.