Forget about the check, we’ll get hell to pay!

U.S. consumers are partying like it’s 1999.

The latest Household Debt and Credit report from the New York Federal Reserve shows that U.S. consumer credit card debt reached a record high in the fourth quarter of 2022, surpassing the previous zenith seen in 2019. Credit card balances in aggregate now amount to $945 billion, zooming towards the $1 trillion mark. According to the report, the increase in the final quarter of 2022 was the largest since 1999, when social mood was through the roof and optimism was sky high.

It’s debatable whether social mood is in quite the same place as it was back then. In many ways, definitely not. Feelings of peace and prosperity abounded as the new millennium dawned. Now, the landscape is of war and real-terms reductions in living standards. Consumers are not maxing out their credit cards because they feel confident, but perhaps because they feel increasingly desperate. The fact that the savings rate has collapsed at the same time as credit card debt has increased speaks to that dynamic.

Undoubtedly, the massive increase in interest rates is influencing consumer debt. As balances grow ever faster because of higher rates, consumers are finding it increasingly difficult to service their burden. 46% of credit card holders are now carrying their debt over month-to-month, up from 39% a year ago. And delinquency rates are increasing.

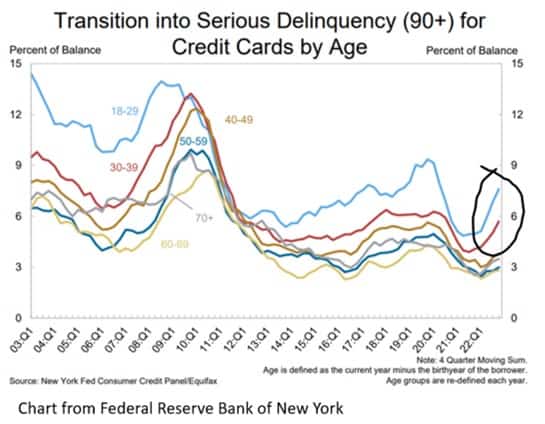

Check out the chart below from the New York Fed’s report. It shows the trends, by age group, of delinquency rates going beyond 90 days (those missing payments for longer than three months). Although the overall rate is not as high as it has been historically, the sharp increase last year in those under the age of forty could foretell of trouble ahead.

A record level of debt need not be a problem if it can be serviced. Evidence might be emerging that it cannot. Debt deflation beckons.