Here’s One Way to Debt Deflation – Just Cancel It

They’re trying to inflate it away, but debt remains the elephant in the room.

This year, Elizabeth II (to use her official title) by the Grace of God, of the United Kingdom of Great Britain and Northern Ireland and of her other realms and territories Queen, Head of the Commonwealth, Defender of the Faith, will celebrate 70 years on the throne. This Platinum Jubilee is truly historic with Elizabeth being the longest reigning monarch ever, striding past Queen Victoria’s 64 years, then an unheard-of feat. Other Jubilees are increasingly being considered.

A “debt Jubilee” is a celebration when “unjust” debts are cancelled. The word ‘Jubilee’ comes from the Old Testament of the Christian Bible and referred to a periodic celebration in ancient times when debts were cancelled, slaves freed, land returned to its original owners and fields left fallow. The “unjust” aspect to the debt derived from bad harvest years which forced people into debt and slavery.

The gargantuan level of global debt, ballooned even further by the Covid pandemic, is increasingly being seen as a problem that can only be fixed in two ways. Either it is “inflated” away (whereby rampant consumer price inflation erodes the real level of debt), or it is simply cancelled in an old-fashioned debt Jubilee. By counterfeiting currency via the digital printing press, central banks around the world are trying their best to cause price inflation. Also, the “helicopter money” that this printing enabled (the stimulus checks direct to U.S. households, for example) could be viewed as a type of debt Jubilee. The government gives households some freshly printed Fed tokens which allows them to pay down their credit card debt, for instance. But other Jubilees are occurring.

News comes from the U.S. where Navient, one of the largest student loan servicers, will cancel $1.7 billion in private loans after a deal was reached with 39 states. Essentially, Navient was accused of lending to people who couldn’t afford the repayments and so, rather than go through the courts, the debt is simply cancelled. Good news for the 66,000 borrowers; bad news for Navient (socionomists will wryly note that its stock price advanced marginally on the day of the announcement).

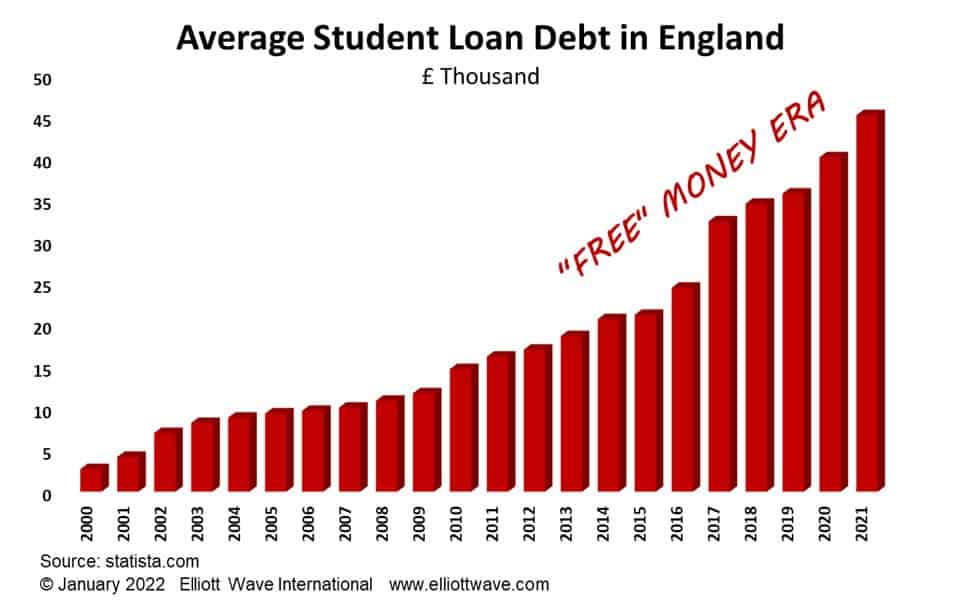

The Socionomics Institute has been writing for many years about the ticking timebomb of student debt in the U.S., but in Europe too it is an issue. The chart below shows the average student loan debt on entry to when repayment starts in England from 2000 to 2021. This explosion in debt is likely being driven by a social mood whereby it is less being seen as a “millstone round the necks” of young adults entering the workforce, but rather as their right, and not something that needs to be paid back. It’s a bit like the cynical old adage: “owe the bank a thousand pounds and it’s your problem; owe the bank a million pounds and it’s their problem.” There comes a point where the level of debt gets so big that it almost becomes irrelevant. If it stays in place, that’s one reason why some economists cannot see interest rates rising too far because it quickly becomes unaffordable to service. Hence the increasing calls for Jubilees.

Perhaps the U.K. government will hark back to ancient times and announce a debt Jubilee to coincide with this year of celebration for Queen Elizabeth. But don’t hold your breath.