How About Deflation Adjusted?

You couldn’t make this stuff up.

Central banks around the world have repeated the mantra (robot-like) for decades now about the need to push consumer price inflation higher. This has come about due to the belief (or propaganda) that consumer price deflation is bad, handily ignoring the historical facts that solid economic growth has been achieved when consumer prices have been falling, the late-1800s America as a prime example. Central banks want us to think that we need to have higher consumer price inflation because it enables them to continually expand monetary policy, support government debt and therefore underpin an expanding state sector.

However, it’s a dangerous game, as the European Central Bank (ECB) is now finding out.

The ECB staff’s trade union, the International and European Public Services Organization (IPSO), is demanding a higher pay increase than that which is currently on the table. The ECB is proposing a 1.3% rise but, with annualized consumer price inflation running at a 5% clip, IPSO states that “no longer protects our salaries against inflation,” and could result in a “permanent loss in purchasing power”. IPSO is demanding that wage gains be linked automatically to the consumer price inflation rate in either Germany or the Eurozone. Such “index-linking” of wages is an echo of the 1970s, especially in Britain, and that didn’t end well. It almost guarantees that high consumer price inflation becomes entrenched. After all, who doesn’t want higher pay, right? And it’s fair to assume that if there was consumer price DEflation then unions would not be happy seeing wages decline.

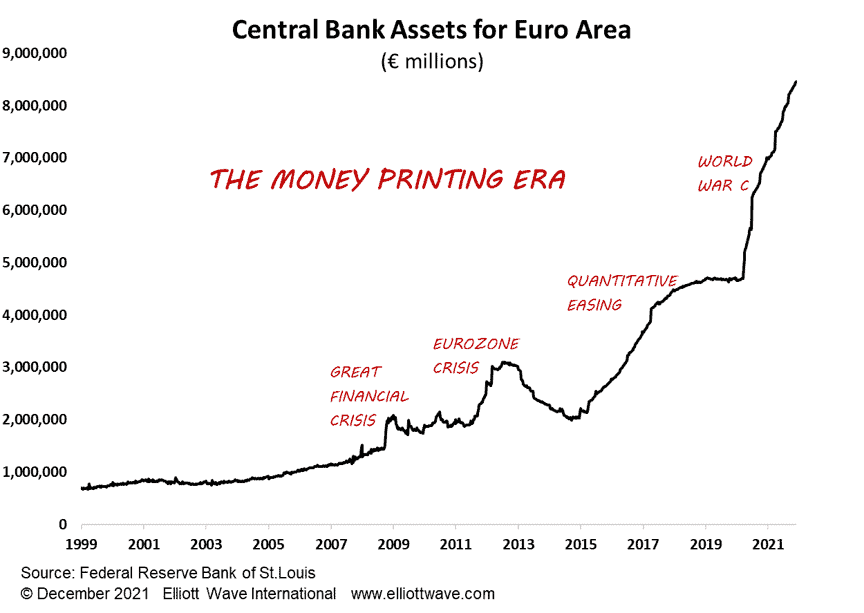

The chart below shows the annualized percentage change in the ECB’s Balance Sheet, essentially proxying the rate of monetary expansion and euro-printing that has occurred. It’s not the only cause of the current high consumer price inflation that the Eurozone is experiencing, but it’s a big contributor.

Thus, we have a situation whereby the very institution that has got what it wanted, is now finding that higher consumer price inflation is not the bed of roses it thought it was.