In the New World, Here’s How Deflation Really Looks

As we enter a virtual reality world, it is giving us a glimpse into the future.

Gaming, the word used to describe the activity of playing video (ok, grandpa) games, is a massive multi-billion-dollar industry these days. In my youth, I spent some happy hours playing the original Space Invaders game, on a stand-up machine, in a smoke-filled arcade, but the only game I play now is the game of the financial markets – the most difficult game in the world (well, apart from golf that is).

Amazon has recently launched a role-playing game called New World and an astute Elliott Wave International colleague alerted me to an article about what is going on. Known as an MMO (Massive Multiplayer Online game), New World gives out “money” or “coin” when a player does something like a kill a monster (a “monster drop” apparently) or salvages an object. Players can then use their coin to buy stuff. The issue is, though, that coin issuance is not enough for coin usage. In other words, the money supply is lower than money demand. Money is scarce. The result? Deflation. The value of money has gone up relative to the goods on offer. In a free market, that would probably result in the price of those goods falling, and some have in New World, but many goods prices are fixed (repairing and property taxes as examples). That has resulted in players creating their own economy and bartering between each other with their in-game possessions. According to PlayerAuctions.com, “Trades such as 1000 linen, for 600 ore and 20 eggs, or star metal tools for 40 steel bars, are commonplace, like what one would expect to see in a hunter and gatherer society.”

A return to a hunter and gatherer society might seem very farfetched in the real world, but it will probably feel close to it when the coming debt deflation ravages the Western world. Central banks have and will no doubt continue to flood the system with counterfeited currency in response to even a 20% decline in the stock market. But that can only last as long as social mood allows it. When mood turns against the central banks, which it will, money and credit will contract dramatically, and barter economies will spring up quickly.

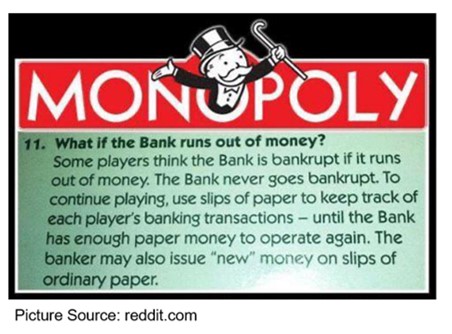

In the meantime, central banks, like the Fed and the ECB, appear to be taking their monetary policies from a classic, pre-internet game, shown below. When the racket is up, many will be going straight to Jail without passing Go.