Is the Doctor diagnosing deflation?

Does the slide in copper mean anything for the economy?

Out of all the industrial metals, copper is probably the most ubiquitous. According to the Copper Development Association, 65% of available copper is used in the electrical industry, 25% in construction, 7% in transport and 3% in various other industries. It’s hard to think of something that we come across in our lives every day that doesn’t have copper in it. It is integral to the economy, and this why the metal has the moniker, “Doctor Copper.” As the price goes up, it is taken as sign of increasing demand meaning that the economy is growing. When the copper price is going down, the economy is assumed to be slowing. Doctor Copper has a super ring to it. But does it work?

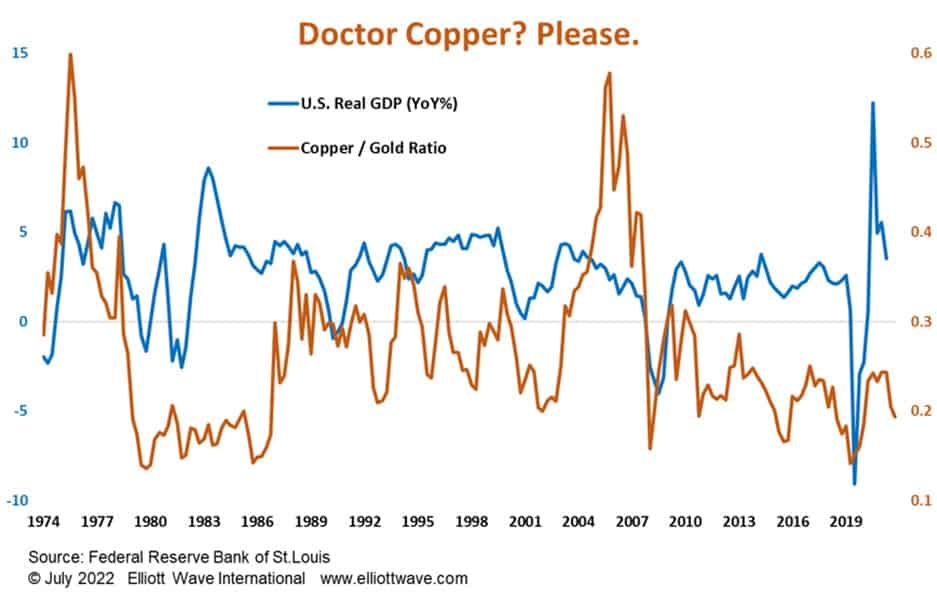

The chart below shows the price of copper relative to Gold, what could be thought of as the real price of copper, from 1974. Alongside it we have the annualized rate of change in U.S. Real Gross Domestic Product. At first glance we can see that there are times when a positive relationship exists, meaning that both lines are going in the same direction. However, there are other times when that is not the case, such as in the early-to-mid-1980s. Indeed, the correlation coefficient between the data sets is only 0.19, indicating pretty much no relationship at all. If we examine the annualized change in the Copper / Gold Ratio versus the same for Real GDP, the correlation coefficient moves up to 0.27: better, but still basically uncorrelated.

What if we look at the relationship between Copper and GDP on a purely nominal basis? In that case, the correlation is only 0.12 for annualized changes and, wait for it, MINUS 0.38 based on nominal Copper prices versus nominal GDP changes. Thus, the evidence is quite conclusive that the relationship between copper and the economy is spurious at best – a cold-hearted realist might even say non-existent.

The current decline in copper is being pointed at by many as evidence that the economy is slowing. We think it is slowing and that deflation is coming, but the fall in the copper price is not the best indication of it.