Japan’s Battle with Deflation. Be Careful What You Wish For.

Japan is getting what it has wanted but is still not happy.

Britain is home to some of the most splendid train journeys. Fans of Harry Potter will recognize this famous scene, a journey you can take through beautiful Scottish scenery. Despite the splendor, a very popular British pastime is to moan about the railways. In 1991, after severe weather caused disruption to much of the rail network, a spokesman for British Rail blamed it on “the wrong type of snow.” Ever since then, that phrase has become a by word for euphemistic and pointless excuses.

It came to mind this week when the Bank of Japan kept its key interest rate on hold at minus 0.10%, despite the fact that consumer price inflation is accelerating higher. Annualized consumer price inflation is now at 0.90%, up from 0.20% previously and expected to reach above 2% soon. This is a result of various factors, not least surging food and energy prices. The Bank of Japan has been trying to stimulate consumer price inflation for decades as it (wrongly, in our view) assumes that accelerating consumer prices is the antidote to deflation. Now, finally, as consumer price inflation might become entrenched, the Bank of Japan is still not happy. You see, it’s the wrong type of consumer price inflation, in its view. The Bank of Japan wants to see wages rising as well as prices and it is far from clear, at this juncture, whether that is happening.

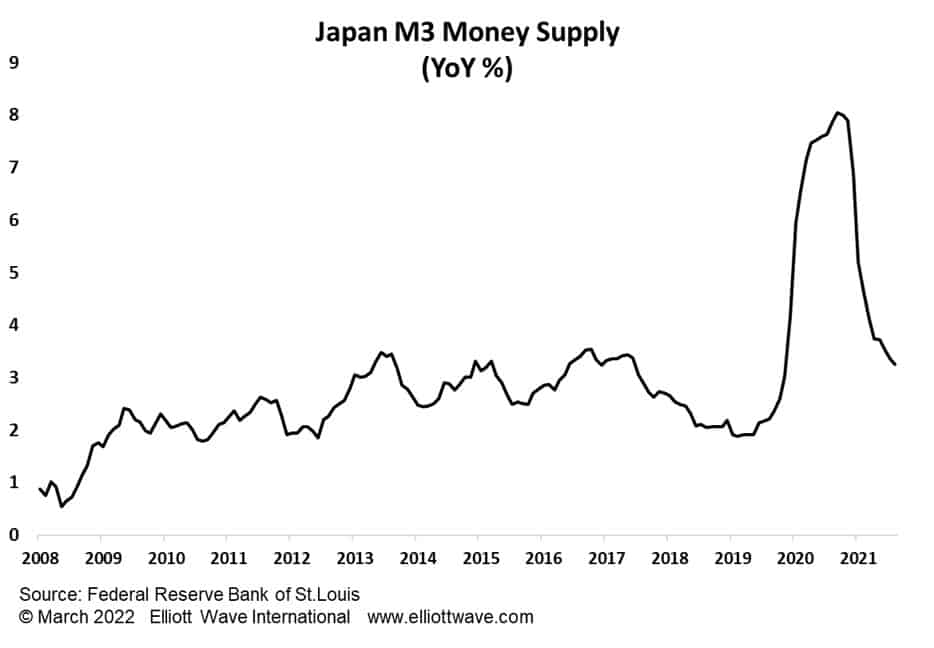

Of course, our view is completely different. The true definition of inflation has nothing to do with consumer prices. It is the growth rate of money and credit in the economy. The Bank of Japan is not letting up in its monetary creation with money supply still growing rapidly as seen in the chart below.

The danger is that, with the misguided obsession over consumer prices, should they continue to accelerate, the Bank of Japan might well end up having to turn the monetary tap off suddenly. Such an abrupt deflation in money supply could have unintended consequences.