Peak Inflation Fears. Is Deflation Next?

We’re probably close to peak price inflation fears.

“History doesn’t repeat, but it rhymes,” said Mark Twain and that is why it is always useful to be aware of the past. As we appear to be in the eye of an inflationary storm, let’s zoom out and take a broad look.

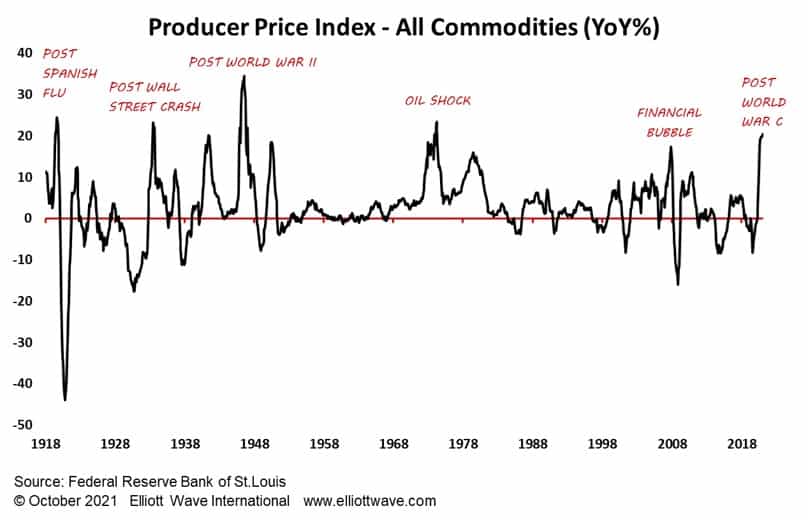

The chart below shows the annual rate of change in the Producer Price Index – All Commodities, as calculated by the U.S. Bureau of Labor Statistics. At an annualized clip of 20.4%, it’s perfectly natural that stories of high energy prices and supply chain disruptions are the top stories in news bulletins. The hysteria of the masses is palpable as the media stokes fears of little Johnny not being able to get his present this Yule (first world problems, indeed.) The narrative is always different, but the chart below shows that this rate of change is close to the fastest in the last century. Rate of change, by its very design, is mean reverting and so the question we should be asking ourselves is, would we buy or sell this chart? What would you do?

If, as seems likely, the rate of change is hitting a peak, it might not be long before talk of price deflation returns.