Printing Presses Switched Back On

It’s all so sadly predictable.

Since it’s Saint Patrick’s Day, let’s start with one of my favorite Irish anecdotes. An American golfer was playing in Ireland and had a local caddy for his round. The first nine holes saw the golfer spraying his shots left, right, out of bounds and into the deep rough. Becoming increasingly frustrated and grumbling, it got worse on the back nine as he lost multiple balls, duffed shots and took many putts on the greens. Eventually, in deep frustration, he turned to his caddy and growled, “You’re the worst caddy in the world!” To which the old Irish caddy replied, “Well, Sir, to be sure, that would be too much of a coincidence.”

The game of golf and investing in the financial markets have a lot in common. Perhaps the most important similarity of all is that both endeavors require an ability to control risk. In golf, you want to avoid quadruple bogies. In investing, you want to avoid blowing up your portfolio with heavy losses. Yet that is exactly what some banks have done by sitting idly by and watching losses on their bond portfolios grow and grow. Result, a loss of confidence and yet another bail out.

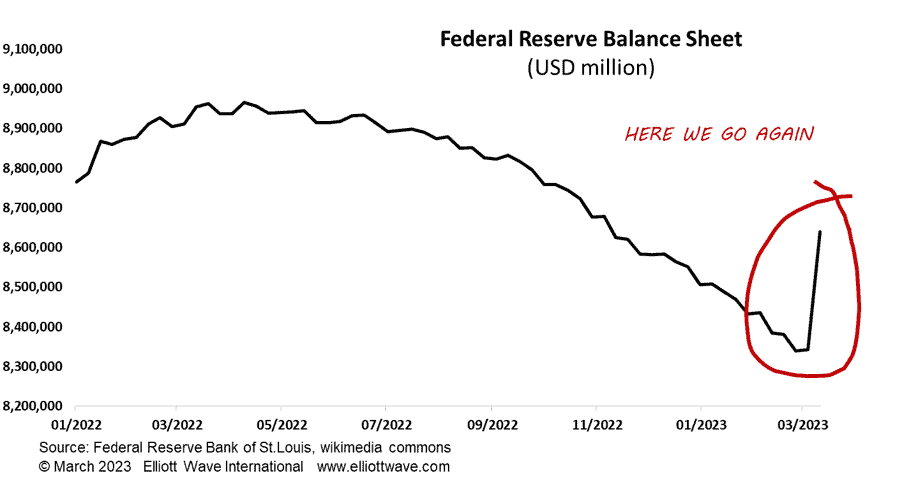

Naturally, authorities are not calling it a bail out. Of course not. But money is being created in order to save banks from failing. The chart below shows that the Federal Reserve has sharply increased its assets on its balance sheet in the last week, quantitative easing reversing the quantitative tightening seen since last year. Banks have swarmed to the Fed’s Discount Window, essentially where a central bank acts in its ‘lender of last resort’ capacity, surpassing even the usage seen during the Great Financial Crisis of 2008.

The question is whether this return of QE will continue or whether it is a one-off. The Fed meets next week so we can expect lots of volatility as the markets grapple with this potential U-turn in policy. Back in 2009, social mood was still in a high degree positive trend and so it allowed the Fed to print money. If our Elliott wave analysis is correct, this time around it might not be so easy (pardon the pun). In fact, we expect the Fed and other central banks to become increasingly vilified as the bear market progresses.