Private Equity Deflation is Coming

But not quite yet.

An article in the Financial Times got my attention thanks to the eye-catching headline, “Amundi warns that parts of private equity market resemble ‘Ponzi schemes.’” Amundi is Europe’s largest asset manager and its chief investment officer (CIO) stated that the private equity industry can look like a “pyramid scheme” in some areas. Essentially, the critique is that private equity firms go around buying and selling assets to each other with ever higher prices and earnings valuations. “It’s a circular thing,” the CIO stated.

Certainly, the private equity sector can be considered to be a bubble on many measures, with more than $6 trillion in assets under management and a huge amount of leverage fueled by the era of free money from 2008. But is the bubble likely to burst soon? This is where Elliott wave analysis can help.

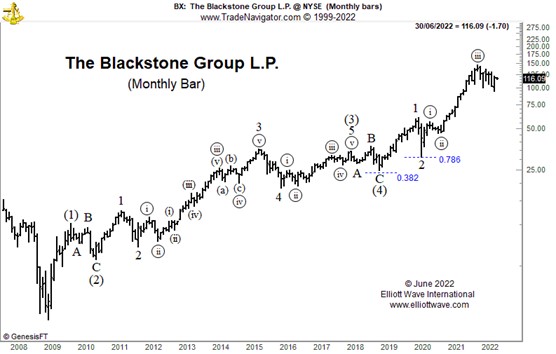

The chart below shows the share price of The Blackstone Group L.P., the iconic private equity giant and representative of the sector’s health. From its low in 2009 we can identify some very clear wave structures within the advance. Note the clear subdivisions in wave 3 of (3) between 2011 and 2015, a very strong advance. Wave 5 of (3) was then truncated, meaning that it didn’t move beyond the end of wave 3, which is something we might expect after a particularly strong wave 3. Wave (4) retraced 0.382 of wave (3), a clue that the labeling is correct and wave 2 of (5) retraced 0.786 of wave 1, something which is common for second waves.

The upshot is that it looks like the advance in wave 3 of (5) is still in progress for Blackstone, meaning that we should anticipate a further advance. The end of wave (5) will determine when the private equity bubble peaks but, on this evidence, it doesn’t look like it’s ready for its deflation just yet.