Snap! Let the Great Deflation Begin

It wasn’t just a well-known stock that dropped a lot last week.

The big news on Tuesday last week was the sell-off in the share price of Snap Inc. Oh, the gloriously excitable headlines from the financial media such as, “Snap Stock Plunges by 40% as Company Slows Hiring,” were splendidly predictable in their causality linkage. Look at a chart of the share price of Snap Inc., though and you will see that the share price had already declined by 72% from its peak in September last year to the start of this week, BEFORE the announcement from the company.

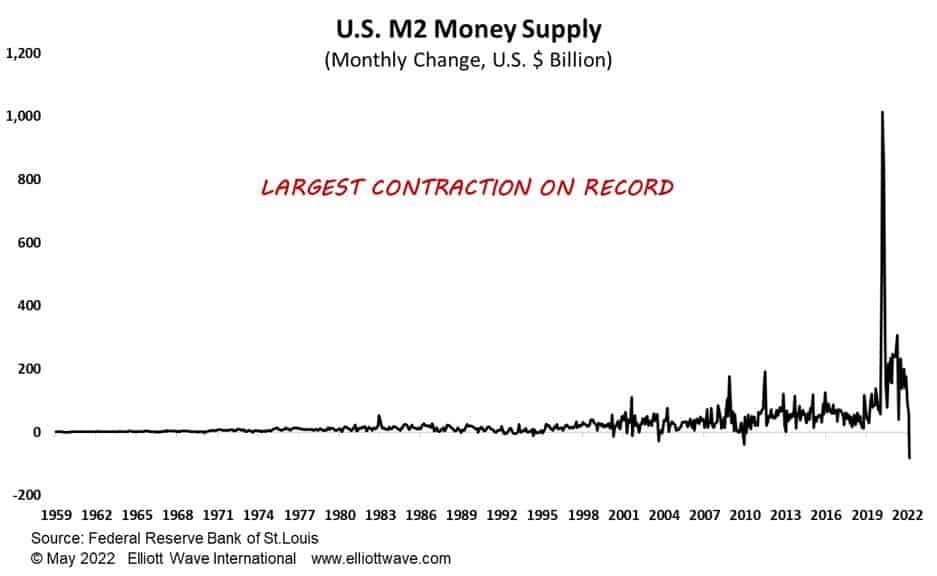

Something else might have snapped last week. The latest money supply data released from the Federal Reserve for April revealed the largest one-month dollar decline in the history of the data set going back to 1959. The measurement known as M2 declined by $81 billion, more than double the previous record monthly contraction in money supply which occurred in 2010. In percentage terms, it was the fourth largest monthly contraction on record. What makes this remarkable is that it is occurring before the Fed really starts to shrink its balance sheet, which will have the effect of contracting the money supply more. What is going on?

M2 consists of small-denomination time deposits and balances in retail money market funds, plus M1.

M1 consists of U.S. dollar currency outside the U.S. Treasury, Federal Reserve Banks, and the vaults of depository institutions. It also contains demand deposits at commercial banks, other liquid deposits and savings deposits.

The record contraction in April has come from M1, and specifically savings deposits.

There could be two main reasons for this. Number one is that households are drawing down their savings in order to counteract the effect of surging consumer prices. If this is correct, consumer demand is on shaky ground and could point to economic weakness ahead.

Another reason why savings deposits are being drawn down could be that households are using that liquidity to invest in the stock market, which would be consistent with other data showing that “buy-the-dip” actions are occurring. This is even more worrying for economic bulls because, if our Elliott wave analysis is correct, the stock market should continue to decline, wiping out those savings.

Either way, this big contraction in the money supply might be a harbinger of the monetary deflation to come.