Stealth Debt Deflation in the U.K.

Britain is embracing higher prices in an attempt to reduce its debt.

Only three things, it is said, can happen to debt. It can be repaid or it can be defaulted on. The third option that economists state is that it can be inflated away. What does that mean?

When it is said that debt can be inflated away, what economists are referring to is consumer price inflation. Higher prices of goods and services in an economy has the effect of lifting a country’s income in nominal terms and thus reducing its debt burden, which remains fixed. Think of it like this. Imagine you have a company which derives its income from selling used cars. Your company has a debt of £100,000 and annual revenue of £200,000. Your debt-to-income ratio is 50%. But then, prices of used cars start to increase sharply and rise by 20% over the course of a year. Now your annual revenue is £240,000. Your debt burden is still £100,000 but your debt-to-income ratio has now dropped to 42%. Hey presto! This gives the illusion that your debt has deflated. The illusion of fiscal responsibility!

This magic trick, of course, has been adopted by governments since the early 1970s when currencies lost their disciplined link with gold as the U.S. dollar has lost 86% of its purchasing power since then. It is the reason why governments love consumer price inflation. Higher prices mean higher nominal income for businesses in the economy and therefore a higher tax take by the government. Why do you think Japan has been so frustrated by not being able to lift its consumer price inflation rate there?

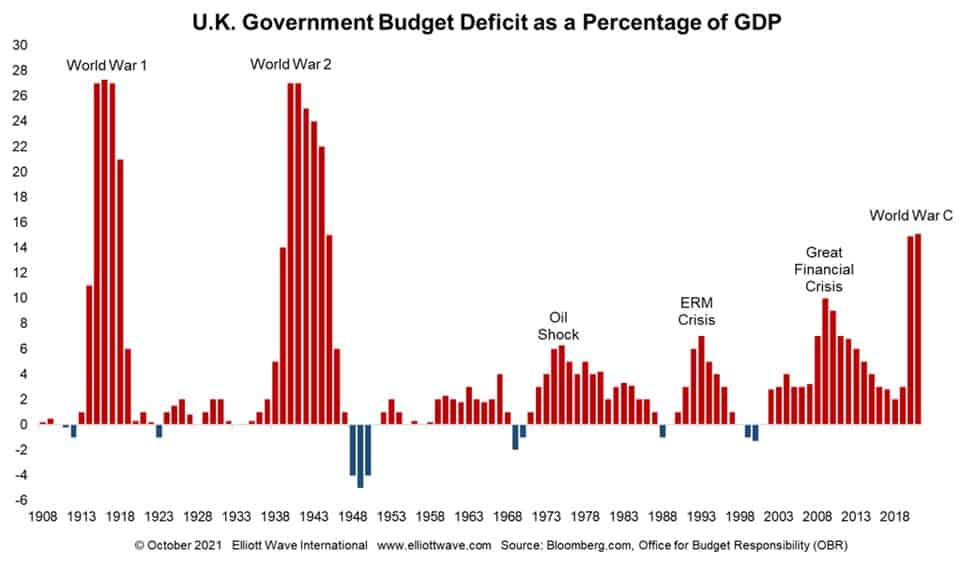

The racket continued this week with the U.K. government budget announcement. Its fiscal expansion plans will increase wages and pump investment into public services, with a consequence being that elevated consumer price inflation expectations might stick. It is a clear attempt to reduce its massive debt burden in terms of national income which currently sits at 103%. As the chart below shows, the U.K.’s budget deficit as a percentage of GDP is the highest it has been since World War 2.

Will it work? Given the history of the last half-century you would probably think it will. But although they like to think they can, governments do not control the economy. The economy’s path is governed by the ebb and flow of social mood, and if our Elliott wave thesis is correct, social mood is on the brink of a sustained negative trend. In that case, if it is accompanied with falling prices, debt burdens actually increase rather than decrease. As opposed to the magic trick adored by governments, that’s when proper debt deflation takes hold via repayments and default.