Summit of the Debt Mountain

A decision by a clothing company whose product became a Wall Street icon might neatly bookend the bubble and presage debt-deflation.

Making the headlines yesterday was Yvon Chouinard, founder of the mountain and outdoor clothing company Patagonia. He has decided to give the company away to a charitable trust with any profit not reinvested in running the business being donated to fighting climate change. With sales of around $1.5 billion per annum, it’s estimated that about $100 million profit will be created annually to be donated to climate causes. The company’s website states, “Earth is now our only shareholder.”

This is the latest, most dramatic, act by the megarich in seeking to re-position capitalism as a caring, sharing endeavor. To be fair, Patagonia has a long history in seeking to be “sustainable,” and environmentalist Chouinard is said to be embarrassed at being a billionaire (poor soul). But, as socionomists, we must, as always, ask ourselves the question: why now?

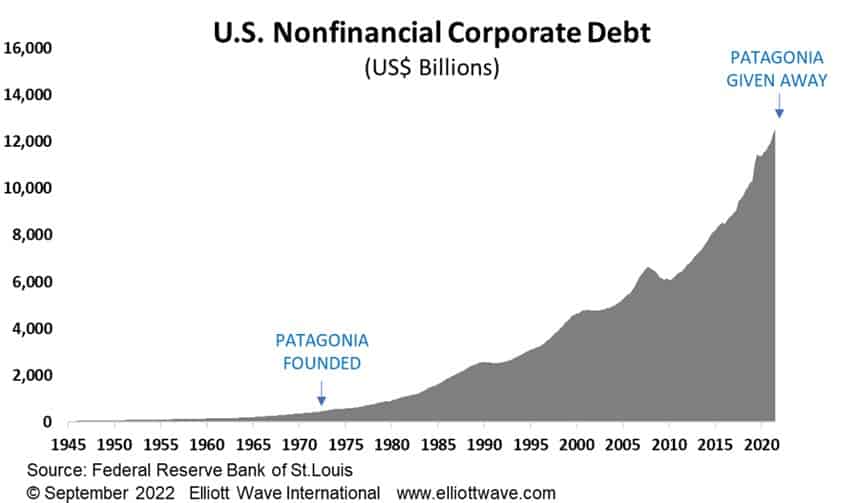

Patagonia was founded in 1973, just as the planet’s economies were delinking from precious metals and allowing currency values to float freely. Since giving up that discipline, inflation and debt have exploded over the past 50 years as can been seen in the chart below. Patagonia, whose products are high-quality with a price to match, has without doubt benefitted from the money and debt bubble of the last half-century, putting its founder in a position to be able to make this decision. Philanthropy is the ultimate luxury and Chouinard joins a list of billionaires who have decided to indulge over the past decade or so as their net worth values have soared. Guess what? Philanthropy isn’t so popular when asset values have plunged.

Curiously, a Patagonia gilet (vest for you Yanks) has become a very popular item of clothing for Wall Streeters to wear (after the demise of the everyday suit). How appropriate, when it looks as though we are cresting the summit of the debt mountain that has so defined the age of finance.