The Chips Are Down at Casino

Get ready for more debt-deflation like this.

“The trouble with the French is that they don’t have a word for entrepreneur,” is an utterance attributed to the former U.S. President, George Bush Jnr. As with most alleged quotations, it’s debatable whether he said it or not, but it’s a good one because it highlights the interwovenness of languages. Take a word like casino, for example. In English the word is universally taken to mean a place for gambling, but the original ‘casino’ from the Italian language, deriving from casa (house), was taken to mean a country villa, summerhouse, or social club.

It was on the site of the Lyrical Casino of Saint-Étienne (a café where musical entertainment took place) that a grocery store stood which would eventually grow into Casino Group or Casino Guichard Perrachon SA. Founded in 1898, Casino evolved to become a global leader in the supermarket industry, pioneering the first self-service store in 1948 and the first to display ‘sell-by’ dates on consumer products in 1959. Towards the end of the last century, Casino expanded internationally and inevitably, debt was central to that strategy. Like all gambles, though, you either win or lose, and it seems that Lady Luck is not with the historic French company.

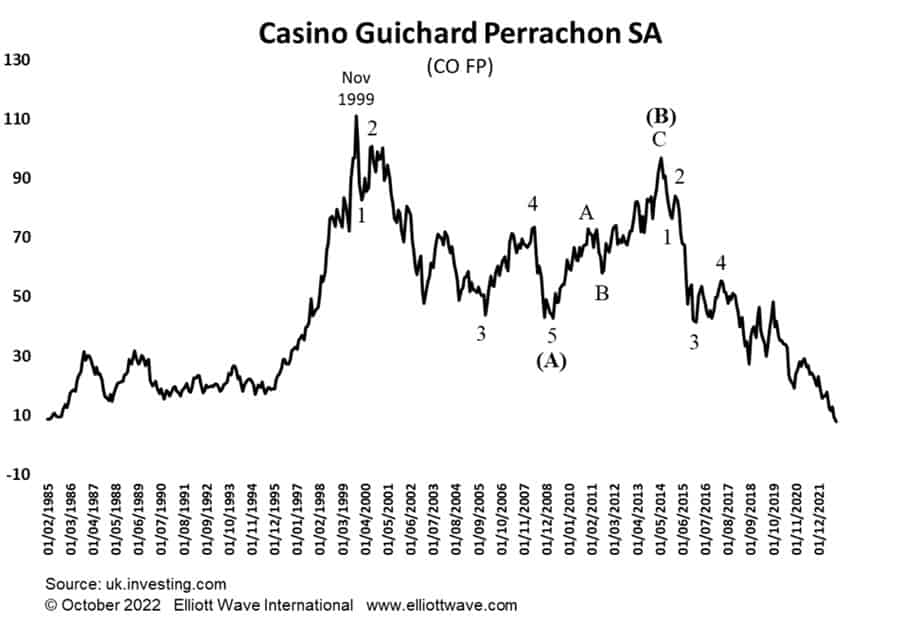

Years of problems were exacerbated last week as ratings agency S&P cut Casino’s credit rating from B to CCC+, expressing concern that the group will not be able to meet its debt obligations over the next 15 months. Casino has been and continues to, sell-off its assets in order to be able to pay what it owes as well as pursuing a strategy of reducing its debt. This is classic debt-deflation, and the share price (below) is a sign of what is probably coming to many corporations and governments in the months and years ahead.

On 31 August, Casino’s share price (CO FP) produced a bear signal on Elliott Wave International’s Trend-Wave radar screens and has declined by 38% since, underlining the powerful moves that Trend-Waves can capture. Having topped out in 1999, whether wave (C) down ends before the share price hits zero is an open question at this juncture.