The Deflation Risk in Stagflation

An Elliott wave can give us a clue for the macro-economic outlook.

I am biased, of course, but I often marvel at the number of aspects in modern life that have a Scot to thank for them. The television and the telephone are the most famous examples, but there are thousands more. The post-Culloden purge in the 1700s and the cultural genocide of the Highland Clearances in the 1800s (calm down: Ed) dispersed Scots far and wide around the world, enabling them to help young nations such as the U.S. flourish. Elliott, by the way, is a Scots name.

The topical term “stagflation,” referring to stagnant economic growth and high consumer price inflation, has a Scottish connection. British politician, Iain Macleod, was the first to use the term in a 1965 speech in the House of Commons:

“We now have the worst of both worlds — not just inflation on the one side or stagnation on the other, but both of them together. We have a sort of ‘stagflation’ situation.”

(Incidentally, Macleod was a “playboy and professional bridge player,” who fought in an eventful war and survived the D-Day Landings. If you like colorful obituaries, his is worth a read here.)

Since Macleod first coined it, the term stagflation has been used widely and is being thought about ever more frequently now. The prospect of a slowing global economy combined with still-high consumer price inflation is causing many to think that stagflation is ahead. Judging by the Elliott wave pattern in the chart below, they might be correct.

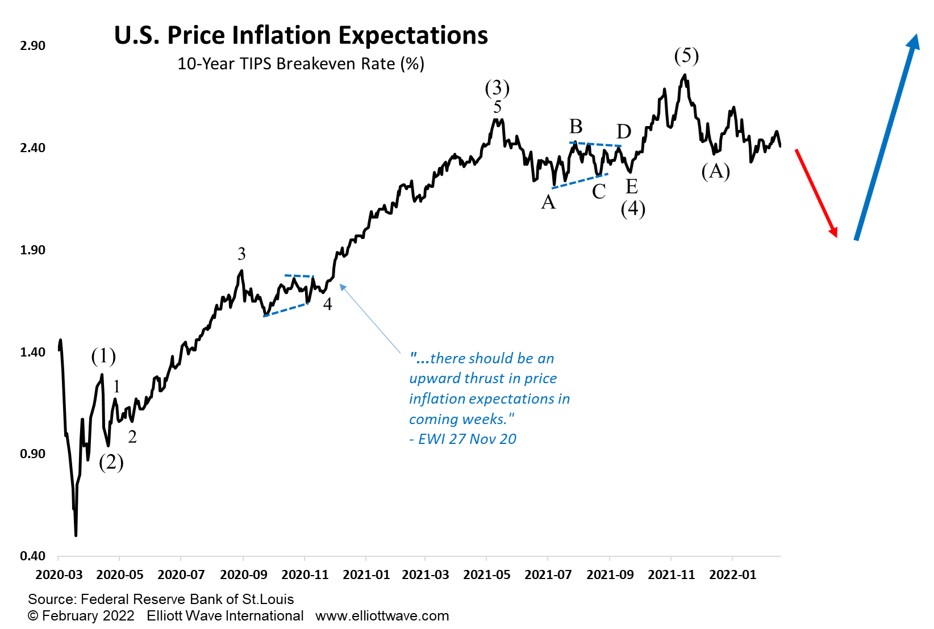

The chart shows the 10-year “Break Even” rate for Treasury Inflation Protected Securities (TIPS), a measure of consumer price inflation expectations. We have shown this chart a few times over the past couple of years, pointing out the clear five wave advance. EWI colleague, Jordan Kotick, has also identified a similar pattern in the 30-year tenor. There are two key takeaways here.

Firstly, the decline from the high is not over and so it seems likely that consumer price inflation expectations, despite all the geopolitical brouhaha, will continue to decline in the short-term.

Secondly, in Elliott Wave terms, a five-wave advance, followed by a three-wave correction would make it almost certain that another advance is coming.

So, do we get a growth scare, which would very probably coincide with private debt deflation, followed by a (war-induced) period of accelerating consumer prices? We can guess all we like. All we know is what the chart is telling us. If this current decline ends up being three waves, as we suspect, get ready for another period of accelerating prices.