The Exploding Debt Burden

Is it sustainable or is debt deflation.coming?

According to the Institute of International Finance, total global debt stands at over $305 trillion. That’s about 350% of global gross domestic product (GDP). Such numbers are, of course, mind-boggling but we have learned to live with them and accept a massive debt burden as normal.

As Elliott wave aficionado and bank credit analyst, A. Hamilton Bolton, noted, major recessions and depressions have historically occurred when debt has become excessive. But how do we know what is excessive?

One way of thinking about it is in terms of debt servicing costs. A household, company or government can have massive debts, but if they can service that debt through increasing revenues then it doesn’t really matter. Put another way, if the growth in money coming in exceeds the cost of servicing the debt, then that debt is not excessive.

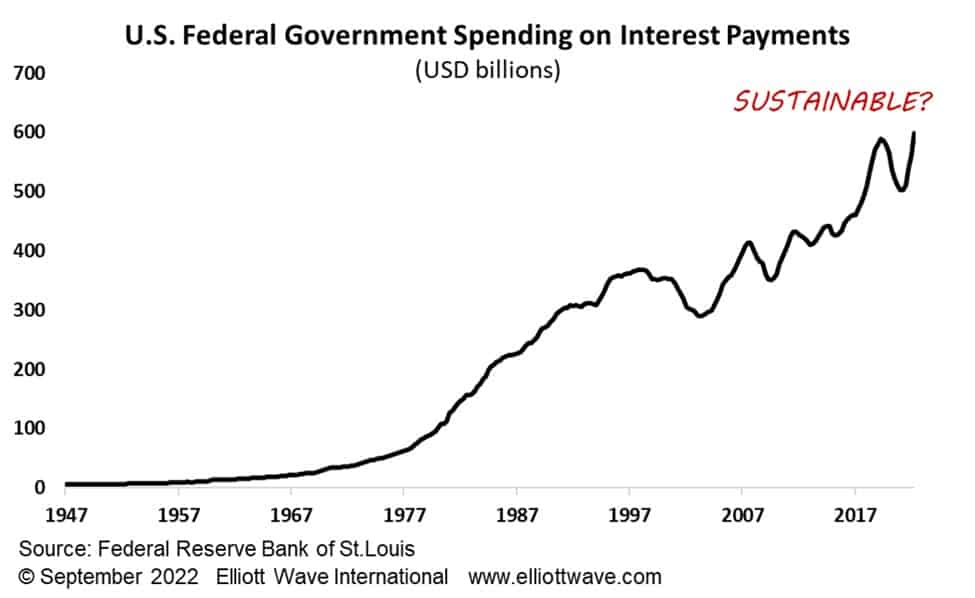

In terms of a country, we could say that questions about excessive debt will be asked if the cost of servicing the debt exceeds the growth in GDP. Well, with interest rates and bond yields zooming up all over the planet, we’re fast approaching that point. The chart below shows that U.S. government spending on interest payments alone has made a new high. Pictures like this will be repeated in many other countries, corporate boardrooms as well as in household budgets.

For the ticking time bomb of debt, interest rates above growth rates could be the straw that finally breaks the camel’s back.