The Fed’s Deflation Dilemma

Never give a box of matches to an arsonist.

The Federal Reserve released its semi-annual Financial Stability Report this week and it made for hilarious reading. The headline quote was:

“Asset prices remain vulnerable to significant declines should investor risk sentiment deteriorate.”

The U.S. central bank identified a list of factors it is worried about. The Chinese real estate sector, emerging market sovereign and corporate debt, the U.S. housing market, crypto stable-coins and meme stocks. The wonks at the Eccles Building in D.C. are concerned that a tightening in financial conditions could cause some or all these factors to threaten the stability of the system.

Right.

This is akin to an arsonist setting fire to a house and then running about in a panic shouting, “Fire! Fire!”

The glaring omission from the list of threats the Fed cited was, the Fed itself! It is inconceivable that Jerome Powell and his cronies do not believe that there is any link between the trillions of dollars they have counterfeited through digital money printing and the asset and debt bubbles they identify as risks to financial stability. Yet no mention of this historic, unprecedented loose monetary policy is made in relation to the current environment. They either have a collective mental condition of cognitive dissonance or they are deliberately trying to create the impression that the financial markets are somehow only affected by tighter monetary policy and not loose.

The asset bubbles which exist now are caused, first and foremost, by positive social mood. Moreover, it is this positive social mood which allows the Fed to propagate its message that it is the potent director of the economy and that only an endless supply of free money can keep the show going. Thus, the trillions of new Fed tokens now flooding the financial system are fueling the mania.

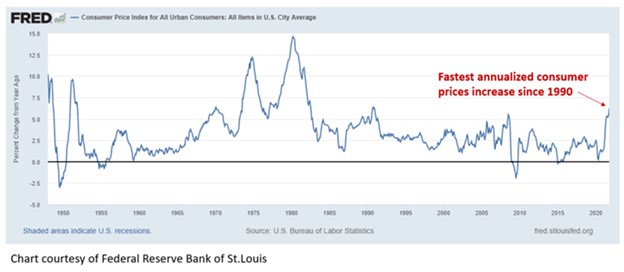

But here is the Fed’s dilemma. It wants to be Wall Street’s friend and see asset prices continue to rise (its main goal is to keep the stock market from falling) but now that consumer prices are accelerating higher (see below) it can see that Main Street is suffering. The Fed knows that it must tighten monetary policy more aggressively than it is planning but, believing its own narrative that it is in control, it cannot bring itself to turn on the hose to dampen the flames it has contributed to. After the hyper monetary inflation it has engaged in, though, monetary deflation is inevitable.

In the end, it doesn’t matter what the Fed thinks or does because the markets (social mood) are in ultimate control. The U.S. 2-year Treasury bond yield has been on the rise since February and spiked higher this week in conjunction with a 6% print in consumer price inflation.

The U.S. bond market was closed on 11 November for Veterans Day. Unlike 1918, the armistice between the bond market and the Fed is unlikely to last.