The Magic Trick of “Inflation” on Debt

Is it real, or just an illusion?

Perhaps the biggest con played on the world over the last century is that governments and central banks have convinced the vast majority of the population that rising consumer prices constitutes what is known as inflation. This has managed to mask the true definition of inflation which is a monetary and debt phenomenon. Increasing levels of money supply and debt is the true definition of inflation and, of course, it has been completely out of control since the financial system finally delinked its discipline with precious metals in the early 1970s. Look at any chart of debt levels in particular and you will see an explosion since the 70s.

But herein lies the con. Governments and central banks say that fast rising consumer prices are pernicious, which they can be, but at the same time the authorities are secretly happy about it because it deflates the level of debt.

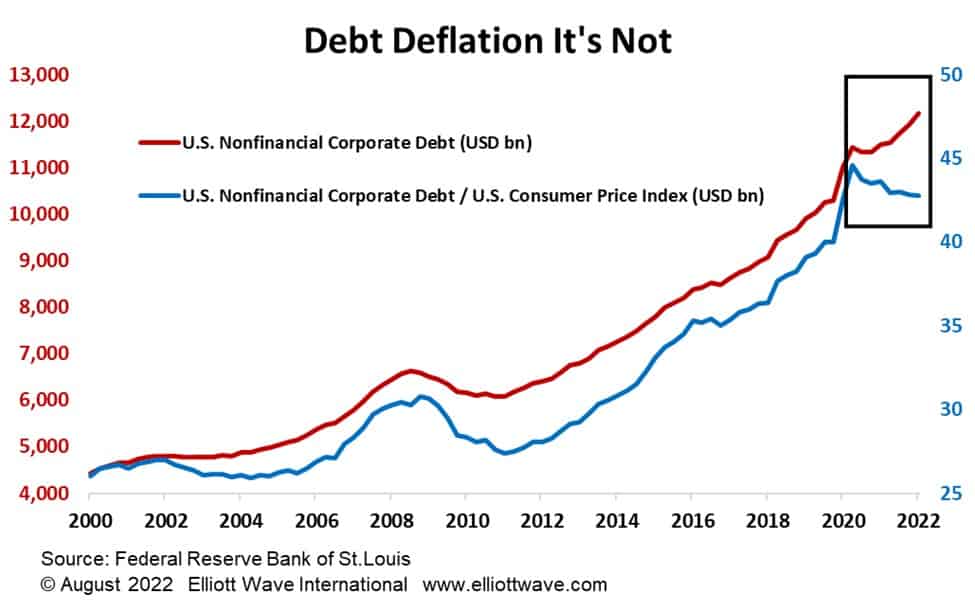

Check out the chart below. It shows the level of U.S. Non-Financial Corporate Debt at a nominal level and also when divided by the U.S. Consumer Price Index. Notice that since 2020, the nominal level of debt has advanced dramatically but when adjusted for consumer prices it has actually declined (a similar situation occurred in the mid-1970s).

This magic trick enables the debt-mongers to claim that ever-increasing levels of debt is not a problem because the rise does not seem so dramatic when adjusted for “inflation,” conveniently forgetting that increasing debt levels IS inflation.

This decline in the “real” value of debt is being repeated across all countries, especially in Europe, and thus, on the face of it, those with high levels of debt can breathe a sigh of relief. It’s an illusion. It’s not consumer prices that matter with debt but asset prices, and when asset prices start to decline, which we think is happening now, excessive levels of debt become a problem very quickly.