The Never-Never Land of Deflation

Credit cards are maxed out as the economy turns down.

When most people think of the phrase “tally man,” they might immediately think of The Banana Boat Song, which became the signature song of crooner Harry Belafonte in the 1950s. You know the one. It starts with, Day-O, Day-ay-O. Aye, that one. In the traditional Jamaican folk song, the tally man is asked to tally (count) the bananas because daylight has come, and they want to go home.

In 1930s depression-hit Britain, so-called Hire-Purchase schemes became very popular because they allowed the purchase of large household items to be spread over a long period of time, but you wouldn’t legally own the item until the last payment was made. Extortionate interest rates were, of course, rife. Once the agreement was entered into, a “tally man” would go around the local district collecting the regular payments – essentially, a debt-collector. Hire-Purchase schemes became known as living on the “never-never,” because you would never pay the item off, and subsequently never own it. Hire-Purchase schemes were the forerunner to credit cards and the term “living on the never-never” has been carried on in reference to someone who lets credit use get out of control.

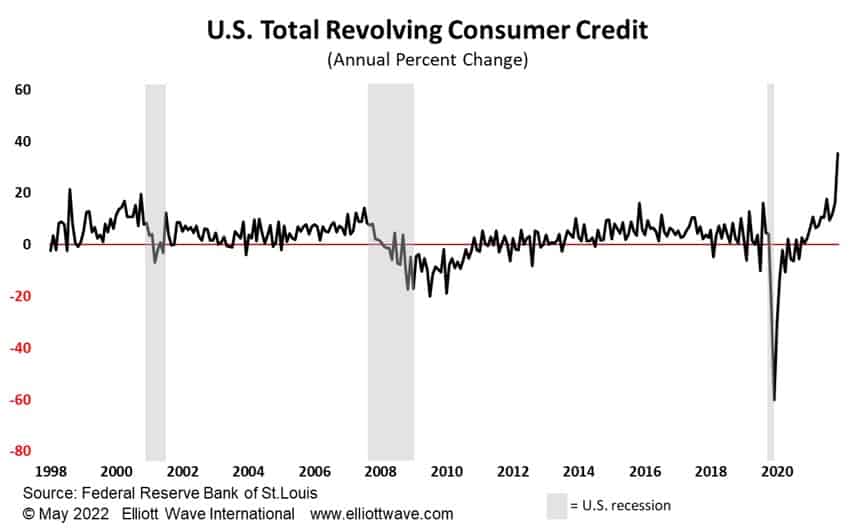

The latest consumer credit figures from the U.S. suggest that a key lynchpin of the global economy, the U.S. consumer, could be living in never-never land. As the chart below shows, total revolving credit (which is mostly credit card debt) is inflating at the fastest rate in over two decades. This is a sign that the consumer is maxing out on credit cards and is happening whilst the personal savings rate has tumbled back down from its pandemic-induced spike to the lowest rate since 2013.

As we can see, the pandemic lockdowns in 2020 coincided with a dramatic deflation in revolving credit. Could this current fast inflation in credit be a reaction to that? Perhaps. Consumers might be thinking that they want to spend, spend, spend, having been locked up for two years, especially on travel and vacations. Whatever the “reasons” behind it, the roaring pace of credit card usage should be a major flag for the economy because rising interest rates and expanding personal credit is a toxic mix. Debt-deflation should ensue.

Later this year, perhaps the consumer will be hearing this in their head…”Oh no! Oh-oh no! Credit bill come, and I ain’t got the sum.”