The Schatz Hits the Fan (Debt Deflation Likely)

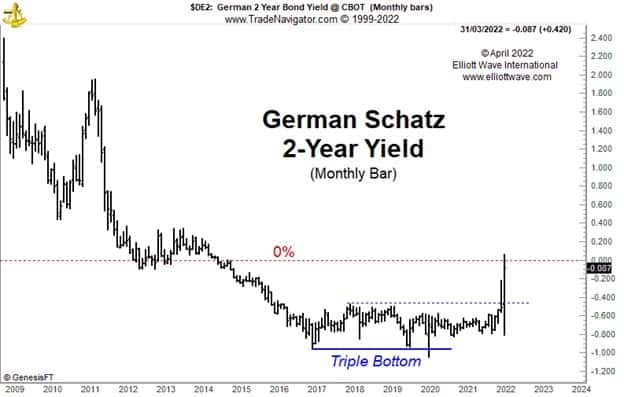

This week, the German 2-year bond (known as Schatz) made a little bit of history. Since 2014, lenders to the German government at this maturity have had to pay for the privilege of doing so, with the Schatz yielding below zero percent. This week, however, the yield crossed back above zero percent for the first time in a Fibonacci 8 years. It’s a significant moment.

As the chart below shows, a Triple Bottom pattern has been confirmed, and it now looks very likely that the yield has established a generational base. The yield has been rising since its low point in 2020 and this week’s break above zero percent corresponded with German consumer price inflation printing a headline 7.3% annualized rate. (It’s worth noting for the causality-mongers that the yield moved above zero on Tuesday and yet the consumer price inflation data didn’t come out until Wednesday).

Rampant consumer price inflation is anathema to Germans for obvious historical reasons. Ironically, this year and next marks the centenary of the hyper-inflation of Weimar Germany. It is one of the events of the early 1920s which is generally considered to have sown the seeds for the rise of Hitler and the Nazis. Thus, with consumer price inflation above 7% now, Germans are feeling increasingly nervous.

Consumer price deflation is clearly not on anyone’s radar screen at this juncture, but the rise in interest rates which is happening around the world (even in Japan!) portends drama ahead. The planet is so indebted, both private and public, that these increases in interest rates that we are witnessing right now will have the effect of making debt servicing costs incredibly difficult for many governments, corporations and individuals. It’s early in the game, but it is afoot.

Higher interest rates making historic debt levels unsustainable means that debt deflation is the very probable conclusion. When that process starts, economies can enter a deflationary spiral which will mean lower asset prices.

Of course, there is another angle whereby central banks and governments are actually pleased about such out-of-control consumer price inflation. There are those who believe that high debt levels can just be “inflated away,” meaning that, in real terms, the level of the debt is reduced when consumer price inflation is high. Could that be a reason why central banks went bonkers printing money over the past 14 years? We’ll leave that to the conspiracy theorists. All we know at this juncture is that surging interest rates are not good for the digestive systems of those with high levels of debt.